As inflation bites into food budgets, Mexican families are swapping beef and chicken for more pork.

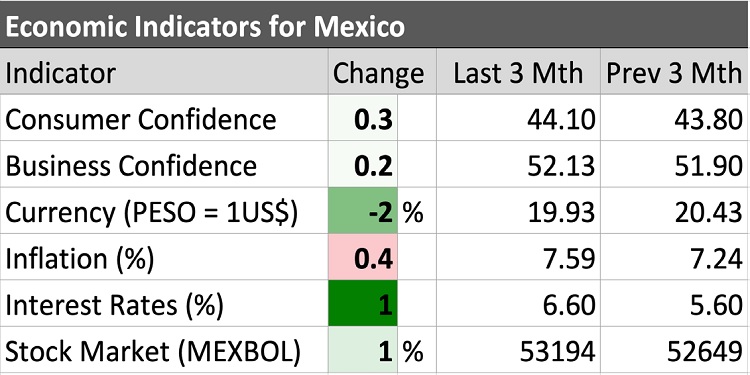

So far in 2022, the Mexican meat sector reported average price increases of 35 per cent, although some meat products have risen to 300 per cent. Inflation accelerated in May and reached its highest level since 2001 due to the persistent increase in food prices. Inflationary pressures continue and food prices are expected to remain high until starting to decline gradually in the third quarter.

The high inflation levels in Mexico have forced Mexican families to modify their consumption preferences. Although overall inflation for goods and services in May eased to 7.65 per cent, in central Mexico the cost of the basic food basket increased by 0.5 per cent.

Read Also

Cattle Market Summary

Break-evens, cow and calf prices, plus market summaries courtesy of Canfax and Beef Farmers of Ontario. Cost of Production October…

During April 2022, all meat categories experienced record increases of 2.2 per cent in average prices compared to the previous month. Beef and chicken suffered the strongest increases, while pork once again became the most consumed protein due to its lower cost. During the last week of April, retail prices for domestic ground beef were US$6.72/kg, chuck US$9.54/kg, and beef tenderloin at US$21.95/kg, while the price for pork chops was US$5.30/kg, and pork loin was offered at US$5.85/kg.

Low prices push pork imports

Low prices for imported pork continue to increase pork purchase volumes, while high prices of beef and chicken have reduced the imported volume of these two proteins. In May, the volume of chicken imports fell 6.3 per cent, impacted by an 18.8 per cent rise in price. Meanwhile a record 600,000 MT of pork was imported, mostly from the U.S, and driven by a nine per cent drop in price.

Mexico will continue to eliminate tariffs on meat imports to control inflation and avoid price pressures. The federal government seeks to increase the supply of animal protein from other countries with less dependence on the U.S. and Canada, from where 92 per cent of the beef is imported. The drought that is hitting the southern states of the U.S. is forcing ranchers to sell their slaughter-ready cattle to Mexican slaughterhouses at a lower price and reaching historically high figures. This has increased the supply of domestic slaughtered beef and reduced the demand for imported boxed beef.

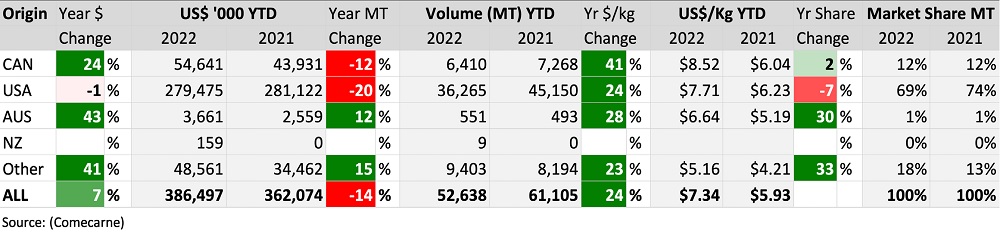

According to figures from the Mexican Meat Council, Mexico’s accumulated beef imports from all sources Jan to Apr 2022 decreased 17.2 per cent in volume from 2021, but increased two per cent in value due to a 23.1 per cent rise in prices. In Jan to April 2022, beef imports from the U.S. fell 19.7 per cent in volume and one per cent in value compared to the same time period in 2021.

Meanwhile the cumulative volume of Canadian beef imports for the same period fell 11.8 per cent vs. 2021 (6,410 MT), and increased in value by 24 per cent (US$54.6 million). Chilled muscle cuts accounted for 80 per cent of total April Canadian beef imports (1037 MT), while the ratio for variety meats was 14 per cent.

Economic uncertainty dampens food service reopening

As Mexico rode its fifth COVID wave, the food service sector was expected to continue to gradually reopen. The Health Secretariat approved full capacity in closed spaces, with no restrictions at commercial premises, restaurants and public spaces. Sales during Father’s Day were expected to be significant for this sector; however, they are still estimated to be 30 per cent below pre-pandemic periods due to the economic uncertainty spurred by higher prices. Additionally, a decrease in optimism among Mexican consumers is projected to further erode sales.