Chicago | Reuters – Chicago Mercantile Exchange cattle futures ticked higher on Thursday on a short-covering bounce, though a weaker cash market and concerns around consumer demand for beef continued to weigh on the market.

Cattle futures also benefited from rising grains futures, which steadied ahead of the U.S. Department of Agriculture’s monthly supply and demand report on Friday.

CME October live cattle futures LCV25 ended 1.125 cents higher at 232.275 cents per pound. Feeder cattle also bounced back, with the October contract FCV25 ending up 1.95 cents at 352.35 cents per pound.

Read Also

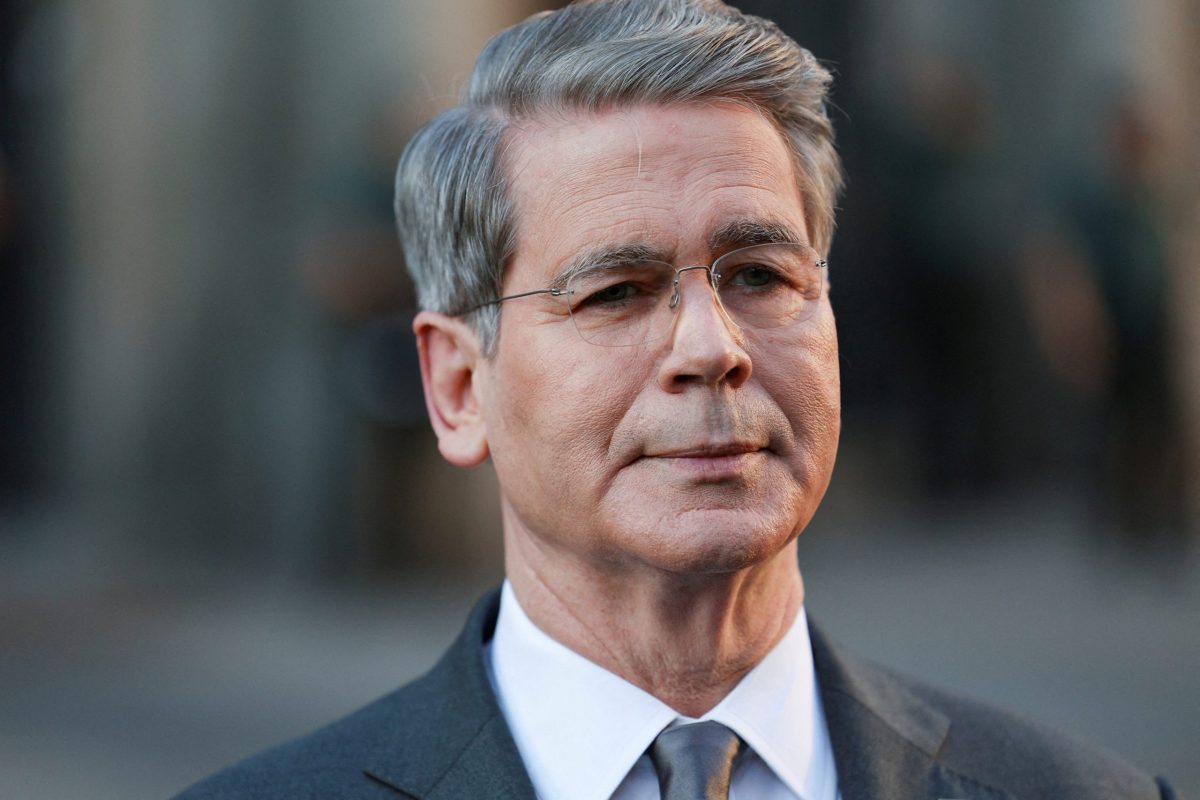

China to buy 12 million metric tons of soybeans this season, Bessent says

U.S. Treasury Secretary Scott Bessent said on Thursday that China has agreed to buy 12 million metric tons of American soybeans during the current season through January and has committed to buying 25 million tons annually for the next three years as part of a larger trade agreement with Beijing.

Traders feared that government data showing the U.S. economy likely created 911,000 fewer jobs in the 12 months through March than previously estimated could be a sign that consumer demand for beef will finally begin to slip after shrugging off months of record-high beef prices.

The USDA said the wholesale choice boxed beef value fell $4.85 to $400.79 per hundredweight on Thursday afternoon. The select cutout fell $3.73 to $379.95 per cwt.

The USDA reported pork carcasses fell $1.60 to $113.17 per cwt.

October lean hog futures LHV25 ended 1.35 cents higher at 98.175 cents per pound.