MarketsFarm — Tightening worldwide chickpea supplies could bode well for prices later this year, although Canadian acres will likely be down and there’s still a long growing season ahead. Canadian farmers intend to seed 175,200 acres of chickpeas in 2022, which would be down 5.5 per cent from the previous year and the smallest acreage […] Read more

Tightening supplies likely to underpin chickpea market

Pulse weekly outlook: Late Prairie seeding may sway acres out of peas

MarketsFarm — Excessive moisture in the eastern Canadian Prairies this spring may cut into pea acres in the region, as producers like to get the crop in the ground early. Canadian farmers intended to plant 3.55 million acres of peas for the 2022-23 crop year, according to a report from Statistics Canada. That would be […] Read more

ICE weekly outlook: Jittery spring market for canola

MarketsFarm — ICE Futures canola contracts saw a sharp downward correction in early trading days of May, after setting all-time highs in April. While the correction was long overdue, underlying supportive influences remain in place and the market could be due for some sideways trade as participants now wait to get a better handle on […] Read more

CBOT weekly outlook: ‘Confluence of events’ keeps corn, soy supported

MarketsFarm — Corn futures at the Chicago Board of Trade hit fresh contract highs on Wednesday, while soybeans also remain well supported with a number of factors likely to keep the grains and oilseeds underpinned going forward. “It’s never just one thing, a confluence of events have taken us up,” said Sean Lusk of Walsh […] Read more

ICE weekly outlook: Trend remains pointed higher for canola

MarketsFarm — The ICE Futures canola market climbed to fresh contract highs once again during the week ended Wednesday, although profit-taking at those highs did slow the advances. While additional corrections are possible, both the underlying fundamentals and technical remain supportive. “This is the bull market of all time in canola,” said analyst Mike Jubinville […] Read more

Feed weekly outlook: Market stagnant as U.S. corn imports continue

MarketsFarm — Feed grain markets in Western Canada are holding relatively steady for the time being, as end-users are well covered with corn imports from the United States. “It seems like most buyers have managed to cover themselves well into June with corn,” said Susanne Leclerc, owner of Market Master Ltd. in Edmonton, adding that […] Read more

Pulse weekly outlook: Larger U.S. pea, lentil areas expected

MarketsFarm — Farmers in the United States will grow more lentils and peas in 2022, although chickpea area may be down, according to early estimates ahead of spring seeding. Total pea area in the country is forecast at 1.088 million acres, which would be up 11 per cent from 2021, according to the U.S. Department […] Read more

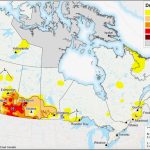

Drought severity easing across much of Prairies, AAFC reports

MarketsFarm — Drought conditions persisted across much of the Prairies during the month of March, although the extent and severity of the dryness was reduced in many areas, according to the latest Drought Monitor report from Agriculture and Agri-Food Canada (AAFC). “While there have been substantial improvements to drought conditions across Western Canada since last […] Read more

ICE weekly outlook: Overvalued canola market due for correction

MarketsFarm — ICE Futures canola contracts climbed to fresh contract highs during the first week of April, but ran into profit-taking resistance and could be due for more losses as the market looks overpriced. “We’re starting to see canola give back some of the extra premium it’s been putting on,” said Ken Ball of PI […] Read more

ICE weekly outlook: Strong canola market to ‘see both sides of rainbow’

MarketsFarm — ICE Futures canola contracts climbed to their highest levels ever during the week ended Wednesday before running into some profit-taking resistance. Its general uptrend remains intact for the time being, but a downturn is also inevitable. The nearby May canola contract hit a session high of $1,177.80 per tonne on Wednesday, before backing […] Read more