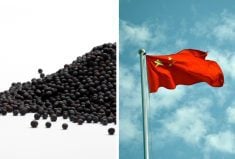

Reuters — China imported no soybeans from the U.S. in September, the first time since November 2018 that shipments fell to zero, while South American shipments surged from a year earlier, as buyers shunned American cargoes during the ongoing trade dispute between the world’s two largest economies.

Imports last month from the U.S. fell to zero from 1.7 million tonnes a year earlier, data from China’s General Administration of Customs showed on Monday, Oct. 20.

Shipments fell because of the high tariffs China has imposed on U.S. imports and as previously harvested U.S. supplies, known as old-crop beans, have already been traded. China is the world’s biggest soybean importer.

Read Also

Australia’s weather bureau casts doubt on prospects for La Nina

Australia’s weather bureau is not convinced that a La Nina weather pattern is forming that could change rainfall patterns and bring wilder weather to parts of the Americas, Asia and Oceania, affecting crop production.

“This is mainly due to tariffs. In a typical year, some old-crop beans would still enter the market,” said Wan Chengzhi, an analyst at Capital Jingdu Futures.

Brazil arrivals last month jumped 29.9 per cent year-on-year to 10.96 million tonnes, accounting for 85.2 per cent of China’s total imports of the oilseed, customs data showed, while shipments from Argentina rose 91.5 per cent to 1.17 million tonnes, or nine per cent of the total.

China’s soybean imports reached 12.87 million tonnes in September, the second-highest level on record.

China has not purchased any U.S. soybean cargoes from this autumn’s harvest. The window for U.S. soybean purchases is rapidly closing as buyers secure shipments through November, largely from Brazil and Argentina, helped by Argentina’s brief tax holiday.

Without a breakthrough in trade talks, U.S. farmers could face billions in losses as Chinese crushers continue sourcing from South America. Beijing, however, may also face a potential supply crunch early next year before Brazil’s new crops hit the market.

“A soybean supply gap may emerge in China between February and April next year if there’s no trade deal in place. Brazil has already shipped a huge volume, and no one knows how much old-crop stock remains,” said Johnny Xiang, founder of Beijing-based AgRadar Consulting.

Trade negotiations between Beijing and Washington appear to be regaining momentum after weeks of fresh tariff threats and export controls. U.S. President Donald Trump said on Sunday he believed a soybean deal would be reached.

For the January-September period, China imported 63.7 million tonnes from Brazil, up 2.4 per cent year-on-year, and 2.9 million tonnes from Argentina, up 31.8 per cent year-on-year.

Even as Chinese buyers are shunning this year’s U.S. harvest, purchases earlier in 2025 mean that year-to-date imports of American beans have totalled 16.8 million tonnes, up 15.5 per cent, data showed.

— Reporting by Ella Cao and Lewis Jackson