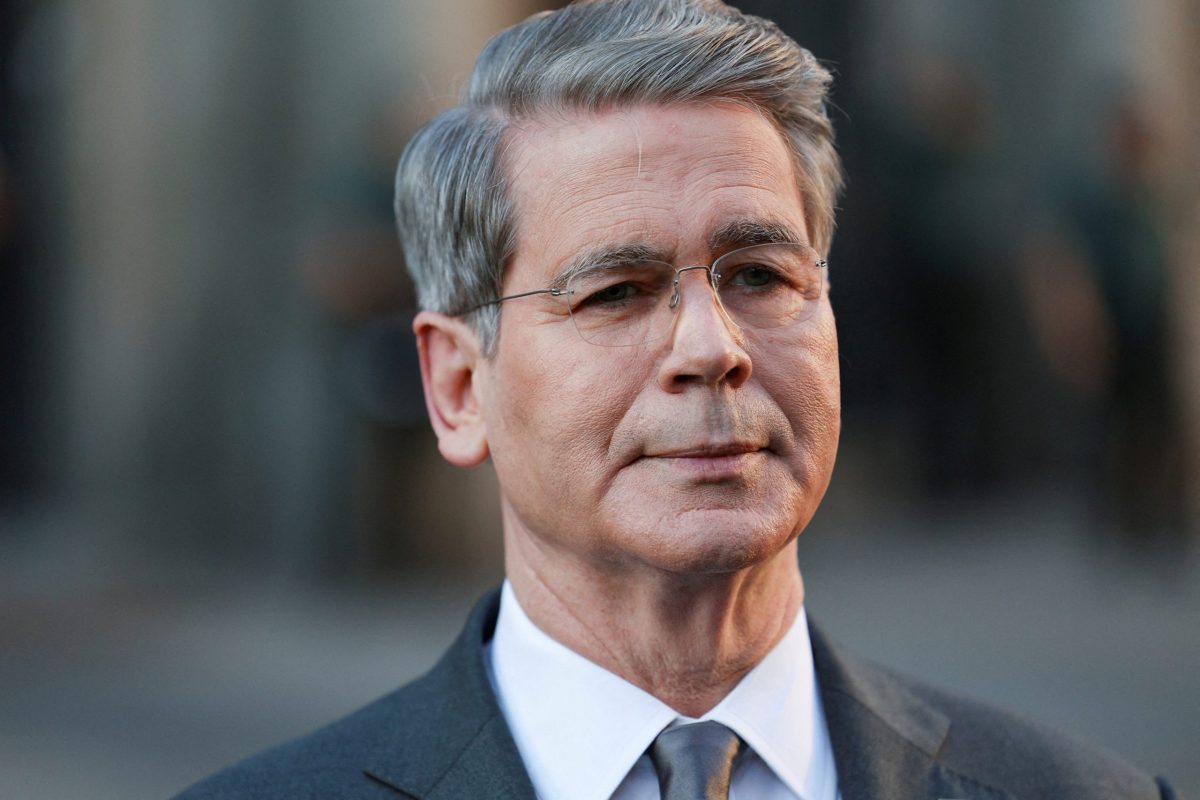

Reuters — Saskatchewan’s PotashCorp, the world’s largest fertilizer producer, is sizing up its chances of gaining control of four companies in which it holds minority stakes, CEO Jochen Tilk said on Wednesday.

Saskatoon-based PotashCorp is reviewing its $4.5 billion worth of investments in China’s Sinofert Holdings, Israel Chemicals, Jordan’s Arab Potash and Chile’s SQM.

“The strategic objective is to obtain some control or participation in the companies,” Tilk, who started as CEO five months ago, said at a Citi investor conference in New York. “We see them as opportunities, but we’re also mindful that we can’t be (in) minority investments forever unless we have a plan going forward.”

Read Also

China to buy 12 million metric tons of soybeans this season, Bessent says

U.S. Treasury Secretary Scott Bessent said on Thursday that China has agreed to buy 12 million metric tons of American soybeans during the current season through January and has committed to buying 25 million tons annually for the next three years as part of a larger trade agreement with Beijing.

The company has long said it wanted majority stakes, but is now conducting a formal review of the investments. Tilk said he is content with the influence Potash holds at Arab Potash and Sinofert.

No decisions have been made, and PotashCorp would not act without consulting the companies involved, Tilk said.

It tried to buy control of Israel Chemicals under previous CEO Bill Doyle, but was rebuffed in 2013 by the Israeli government, which holds a golden share.

PotashCorp, which produces potash, nitrogen and phosphate, is also examining its phosphate operations. It is trying to improve phosphate profit margins but considering alternatives as well, Tilk said.

“Whether or not phosphate is core for us or isn’t, we haven’t resolved that at all,” he said.

Scotiabank analyst Ben Isaacson said in a note this week that PotashCorp may be shopping the phosphate business.

Tilk also said he does not expect rival Uralkali to resume potash production at its flooded Solikamsk-2 Russian mine anytime soon.

“When you have an incident of that severity, it takes time to assess… You’re talking about months, if not beyond that.”

Tilk expects prices to rise in the 2015 potash contract between Canpotex — owned by PotashCorp, Mosaic Co. and Agrium — and China’s Sinofert, but could not say when the deal may be reached.

— Rod Nickel is a Reuters correspondent based in Winnipeg.