Chicago | Reuters — Chicago corn futures ended higher on Wednesday as traders anticipated strong export sales would continue.

Soybeans moved higher, as traders turned attention to the U.S. Department of Agriculture’s monthly supply and demand report on Feb. 9, expecting to see a continued tightening of ending stocks. Wheat followed corn and soybeans, turning higher after early declines.

The most-active corn futures contract on the Chicago Board Of Trade settled up nine cents at $5.52 per bushel (all figures US$).

CBOT soybean futures gained 16-1/2 cents to end at $13.71-1/4 per bushel, while CBOT wheat added 3-1/2 cents to $6.48-1/4 per bushel.

Read Also

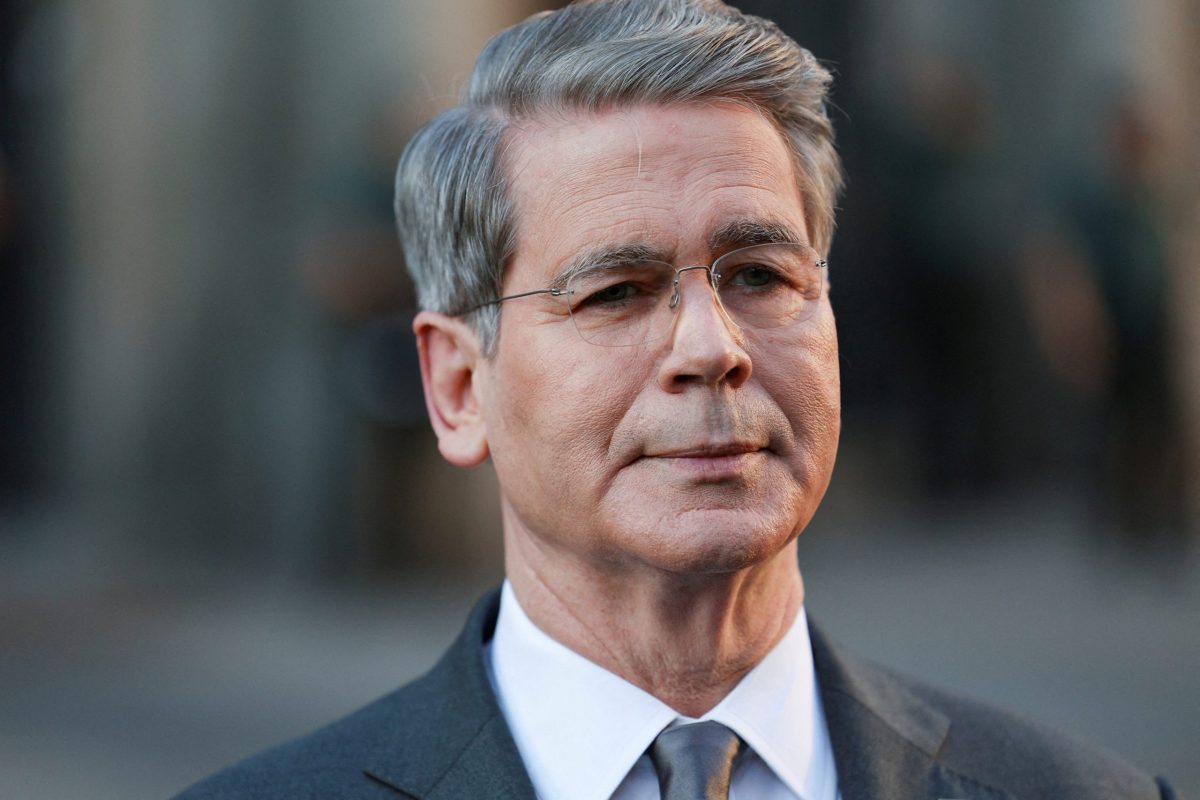

China to buy 12 million metric tons of soybeans this season, Bessent says

U.S. Treasury Secretary Scott Bessent said on Thursday that China has agreed to buy 12 million metric tons of American soybeans during the current season through January and has committed to buying 25 million tons annually for the next three years as part of a larger trade agreement with Beijing.

USDA’s weekly export sales report, due Thursday morning, is expected to show record corn sales, but much of that could already be factored into the market, said Tom Fritz, commodity broker at EFG Group.

“Corn sales have been advertised, given the daily announcements we saw a week ago,” he said. “I think all eyes are waiting on the USDA next Tuesday,” he added, referring to the monthly report.

USDA could tighten its forecast of U.S. soybean ending stocks in that report, despite a lack of daily sales notices, said John Zanker, market analyst at Risk Management Commodities, noting that soybean futures could still climb higher.

“I’ll be surprised if we don’t go back and see those highs. That may get started next week if the USDA lowers that carryout,” he said.

Grain markets remained underpinned by risks to South American supply.

Argentine agricultural exports were disrupted on Wednesday as truckers blocked roads around the Buenos Aires ports of Bahia Blanca and Quequen and authorities cleared roads near the country’s main export hub of Rosario.

In Brazil, a rain-hampered start to the soybean harvest was also raising doubts about how soon Brazilian exports will be available to help meet Chinese demand.

— Reporting for Reuters by Christopher Walljasper in Chicago; additional reporting by Gus Trompiz in Paris and Colin Packham in Canberra.