Chicago | Reuters — Chicago Mercantile Exchange live cattle futures eased on Monday, with a mild round of profit-taking pulling prices from eight-year highs.

But concerns about tight supplies limited the selling.

Hog futures also were weaker, pressured by a government report that showed robust stocks of pork.

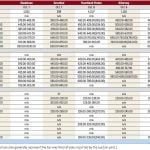

Thinly traded February live cattle futures dipped 0.2 cent to 165 cents/lb. after reaching 165.675 cents, the highest for the front-month contract since January 2015, on Friday (all figures US$).

Most-active April live cattle closed 0.4 cent lower at 164.975 cents/lb. but set a contract high of 166.4 cents during the session.

Read Also

U.S. livestock: Feeder cattle hit contract highs on tight supply

Chicago | Reuters – All Chicago Mercantile Exchange feeder cattle futures and most live cattle futures hit contract highs on…

Wholesale boxed beef prices were mixed. Choice cuts were priced at $286.96/cwt on Monday morning, down 32 cents from Friday, according to U.S. Agriculture Department data. Select cuts rose $1.97, to $279.05/cwt.

CME March feeder cattle futures settled 0.1 cent higher at 189.175 cents/lb. The front-month contract hit its highest since November 2015 during the session.

CME April lean hogs ended 1.3 cents lower at 84.725 cents/lb., while June hogs dropped 1.375 cents to 102.1 cents.

USDA said on Friday afternoon that pork belly stocks as of Jan. 31 stood at 70.134 million lbs., 57 per cent higher than a year earlier.

— Mark Weinraub is a Reuters commodities correspondent in Chicago.