Chicago | Reuters — CME Group lean hog futures rallied on Tuesday, supported by fund buying and expectations that supplies will begin to tighten in the coming weeks, traders said.

Live cattle futures eased slightly for the second day in a row as the market waited for fresh bullish inputs before driving prices above the 4-1/2-year high hit on Friday. Firm cash markets kept the declines in check, traders said.

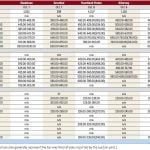

CME December lean hogs rose 1.925 cents, to 77.725 cents/lb., and February hogs ended up 2.1 cents, at 83.275 cents.

Read Also

U.S. livestock: Feeder cattle hit contract highs on tight supply

Chicago | Reuters – All Chicago Mercantile Exchange feeder cattle futures and most live cattle futures hit contract highs on…

CME’s most-active February live cattle contract dropped 0.225 cent, to 136.1 cents/lb. The spot December contract eased 0.5 cent at 131.725 cents/lb.

Wholesale boxed beef prices were weaker, with choice cuts falling 15 cents to $283.05/cwt and select cuts dropping $1.11, to $266.17/cwt, on Tuesday morning.

CME January feeder cattle futures added 0.8 cent to end at 159.275 cents/lb.

Analysts were expecting a U.S. Agriculture Department report on Friday to show that the number of cattle on feed as of Nov. 1 stood at 99.8 per cent of the year-earlier total. Placements during October were 102.2 per cent of the October 2020 total.

— Reporting for Reuters by Mark Weinraub in Chicago.