Chicago | Reuters — Chicago Mercantile Exchange lean hog futures recovered from contract lows on a round of technical buying on Tuesday, traders said.

Traders also noted the recent declines may spark interest in the export market.

“U.S. pork has become some of the cheapest in the world and it would appear we’re indeed starting to see international trade come our way,” brokerage StoneX said in a research note.

Cattle contracts also ended higher, with strength in the cash market spilling over into futures prices. A decline in corn futures, which makes feed costs cheaper for cattle producers, added support.

Read Also

U.S. livestock: Cattle fall sharply as Trump says he’s working to lower beef costs

Chicago cattle futures fell sharply on Friday after U.S. President Donald Trump said his administration was working to lower the…

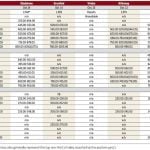

Most actively traded June lean hog futures settled 1.1 cents higher at 84.4 cents/lb. (all figures US$). The contract found technical support at the low end of its 20-day Bollinger range, after hitting a new low of 82.725 cents.

Tyson Foods plans to resume slaughtering pigs in mid-May at a Madison, Nebraska pork plant damaged by fire two weeks ago, the meatpacker said on Tuesday.

August feeder cattle gained 3.025 cents to 226.125 cents/lb., rising above its 30-day moving average during the session.

June live cattle settled up 1.5 cents at 163.925 cents/lb., breaking through its 30-day and 10-day moving averages.

— Mark Weinraub is a Reuters commodity correspondent in Chicago.