Recent changes to the Livestock Price Insurance program give cow-calf producers a few more tools to protect themselves against market risk.

The Livestock Price Insurance Program, available to Western Canadian producers, protects producers from a range of market risks such as a rising Canadian dollar, a drop in the futures market, changes in basis levels between the U.S. and Canada, or high feed costs driving down calf prices, explains Brian Perillat, senior analyst at Canfax.

“You’re then protected across all market factors, really, and it’s a Canadian-based product,” he says.

Read Also

Pen riders still better than tech at detecting respiratory disease in feedlot cattle, says researcher

Recent research found that pen riders are better than tech at flagging signs of BRD in feedlot cattle

Cow-calf producers, feeders and feedlots are eligible to purchase insurance under their respective programs. Producers can insure a floor price on their animals. If the market drops below that floor price, they will receive a payout, whether or not they sold their animals on that date, and regardless of what they were paid for those animals.

The feeder and fed programs are open for purchases year-round. The program recently expanded its buying and settlement windows for cow-calf producers as well. Previously, the deadline for purchasing calf insurance was the end of May, but producers can now purchase insurance as early as February and right up to June 10, 2021. Purchase hours on Tuesday, Wednesday and Thursdays are available from 2 p.m. to 11 p.m. MT.

The calf insurance program also now offers settlements into January and February. Settlement hours on Mondays are now offered from 2 p.m. to 11 p.m. MT.

Using price insurance strategically

The expanded buying window gives cow-calf producers more chances to purchase insurance incrementally through the spring, at different coverage levels.

“Strategically, it’s a very flexible program,” says Perillat. A producer can buy insurance on anywhere from one calf to the entire crop at any time within the buying window, he explains.

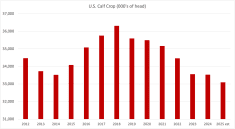

As the market shifts, once you get into a certain window, “it’s almost impossible to buy at the top,” says Perillat. Some producers may wait until May until purchasing all their insurance, hoping for a seasonal improvement in calf prices. But buying some coverage early protects producers from unexpected market drops, like the one seen in May 2020.

Buying in increments allows producers to buy more insurance if calf prices improve. If prices drop, “at least you’re covered at that higher rate that you started to buy at,” he adds.

The program offers different coverage levels producers can play with as they buy the insurance, Perillat says. Many producers buy enough insurance to cover their break-evens. Perillat challenges producers to think about a different strategy.

“If you can guarantee a profit by maybe spending a few more dollars a calf…why not do that? Or at least why not do some of that?”

For more information on the Livestock Price Insurance Program, visit lpi.ca.