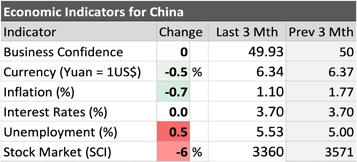

As Omicron hits new highs in parts of China, local authorities are trying to adopt pandemic measures that won’t hammer people’s livelihoods.

However, the worst-affected cities or regions still must adopt partial or total lockdown policies. The epidemic will affect the economy in the short term, especially offline consumption in areas such as tourism and catering.

Read Also

Pen riders still better than tech at detecting respiratory disease in feedlot cattle, says researcher

Recent research found that pen riders are better than tech at flagging signs of BRD in feedlot cattle

China imported 314,641 tonnes of beef as of the end of February, which is 22 per cent down from the same period in 2021. This is mainly due to Brazil’s beef volume (-68 per cent) still recovering from the resumption of trade in late 2021. With beef prices staying high, the total import value was up six per cent compared with 2021.

U.S. beef volume continues to grow with a 92 per cent increase in January and February, vs. 2021. Meanwhile Aussie beef volumes were flat with 2021. Canadian beef volume dropped 19 per cent compared with 2021, due to the continued import suspensions.

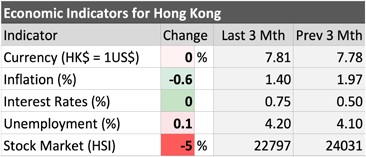

Hong Kong’s fifth COVID wave is still ongoing, but the numbers of confirmed cases are dropping. While maintaining the strict social distancing policy, the government has lifted flight bans for some countries, reduced quarantine days for overseas travellers and has plans to gradually lift social distancing measures, including the foodservice restrictions.

Given the fifth outbreak’s severe effect on the local economy, in April the government launched the first phase of a coupon program, distributing coupons to Hong Kong residents to help boost local consumption.

Total import beef volumes in Hong Kong declined by 37 per cent to 59,280 tonnes in January and February, compared with the same period in 2021. The decline is mainly due to the economic recession caused by the ongoing impacts of the pandemic as well as high beef prices. Canadian beef volumes were down significantly by 81 per cent while U.S. beef volumes also declined by 63 per cent.

Omicron pushes retail sales online

Chinese cities heavily affected by the Omicron outbreak, especially those with partial or total lockdown measures in place, saw a surge in retail orders, especially online purchases which increased by two to three times the norm. Demand for vegetables and meat, essential for daily life, is particularly strong. At the same time, logistics and processing are also facing great challenges due to epidemic controls in various regions and the resulting shortage of manpower. Local regulators may also have extra requirements or even restrictions for retailers to sell imported meat.

Hong Kong’s retail sales in February 2022 grew by an average of 30 per cent thanks to social distancing measures that encouraged consumers to eat more often at home. However, the growth of retail sales slowed in late March as the epidemic gradually abated. Online e-commerce traffic reached historic and record highs in February and March. HKTV mall, the largest online platform, saw an 87 per cent increase in the value of transactions in February compared with the previous year. Despite strong demand, a shortage of manpower for beef cutting, packing and logistics may also lead to potential shortages at retail stores.

Omicron cuts foodservice sales

China’s foodservice sales have been hammered in the worst-hit cities due to restrictions on restaurant dining and catering. Even in regions or cities which have not been heavily affected by the pandemic, foodservice sales have declined as consumers are cautious about eating out and fewer people are travelling. The reduction in foodservice sales has greatly reduced beef sales, leading to slow-moving beef inventories.

In Hong Kong, due to the restrictions on foodservice at the beginning of pandemic, restaurant sales have fallen by about 70 per cent compared to before the outbreak. So far, 3,000 restaurants have been temporarily closed and 400 have shut down completely. Forecasts predict that by the end of April, 7,000 restaurants will have temporarily closed and 2,500 will have shut down completely. With the epidemic gradually easing, the government lifted the restrictions in late April and restaurant operators are seeing a rebound in demand for dine-in service.

Costs rise and sales drop for importers

China’s pandemic control measures in the main ports such as Shanghai and Shenzhen did not suspend port operations. But it did slow things down, causing some cargo accumulation. Cancelled air cargo flights to Shanghai may push freight costs higher, due to airport changes.

As for the suspension of Canadian beef imports, Chinese importers are concerned about the potential risk of inventory shortage and are looking forward to the resumption of trade as soon as possible.

Value, Volume, Price and Market Share % of China’s Beef Imports from Major Suppliers (February 2022, YTD)

Meanwhile in Hong Kong, the manpower shortage for beef processing at suppliers has improved considerably as Omicron has eased. However, due to the foodservice restrictions implemented earlier, restaurant sales are sluggish and beef sales are also slow. Beef importers and distributors are suffering an average 40 per cent sales drop.

Many of Hong Kong’s ingredient suppliers are in trouble as well, with an estimated 10 per cent shutting down their business. As import volumes of food ingredients are also down sharply by around 40 per cent, the industry predicts higher food costs by the time foodservice sales rebound.

Value, Volume, Price and Market Share % of Hong Kong’s Beef Imports from Major Suppliers (February 2022, YTD)