The U.S. beef market has been taut, welcoming sales of Canadian beef in September 2022.

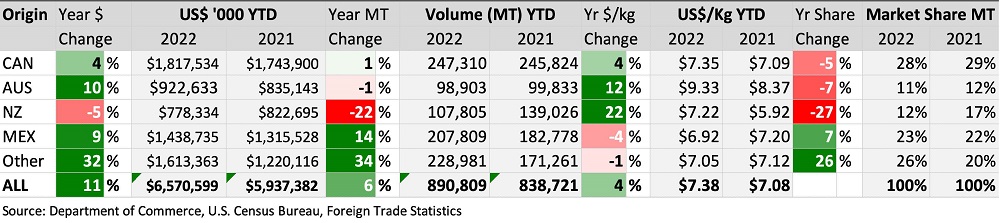

U.S. imports of Canadian beef in September 2022 were up 4.3 per cent from September 2021 and up 17 per cent from the five-year average for September. September imports were the largest monthly volumes since October 2021. Import values in September 2022 were down 6.9 per cent from September 2021, when there was unusually strong demand for middle meats that supported import prices. Although lower year-over-year, import values in September 2022 were up 45.1 per cent from the five-year average.

In October 2022, beef inventories in cold storage declined 3.1 per cent from September 2022 and deviated from the five-year trend of increasing October inventories. The drawdown occurred despite steady cutout values and higher slaughter, a sign of continued, steady demand for beef. Strong domestic slaughter — including higher slaughter volumes of mature cattle due to drought — has pressured import volumes.

Read Also

Factors influencing cattle feeder market during the fall of 2025

Market analyst Jerry Klassen weighs in on live cattle markets

Ribeye and ground beef hold steady at retail

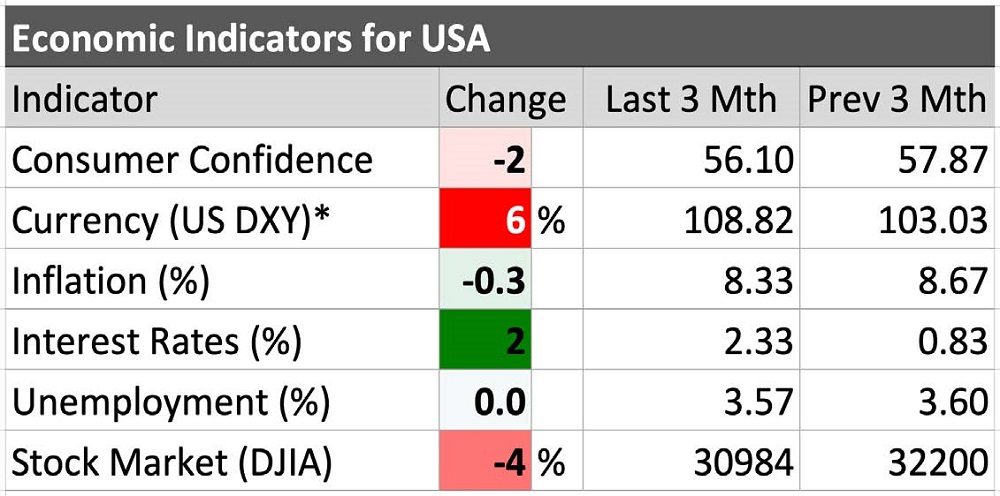

The U.S. all-fresh beef price declined one per cent from September to October 2022 to US$7.25/lb (US$15.98/kg). The move marks the largest month-over-month price decline since November to December 2021 (-2.3 per cent) and a downward deviation from an otherwise steady year for all-fresh beef prices. In October 2022, the all-fresh retail beef price was 4.0 per cent lower than in October 2021 and the lowest since August 2021, but remained 17.3 per cent higher than the five-year average for October.

The Kansas State Meat Demand Monitor showed that consumers were willing to pay higher retail prices for all proteins from September to October 2022. Retail remains the lower-cost option for consumers under economic pressure when compared to foodservice channels. Market share for ribeye and ground beef remained steady month-over-month whereas a one per cent increase in market share was reported for pork chops and chicken breasts. The largest increase in what consumers were willing to pay more for was rice and beans. The monitor also reported changes in consumer behaviour at retail, with 30 per cent of consumers reducing the number of meat items they bought, 24 per cent purchasing smaller packages and 16 per cent buying different cuts.

Foodservice customers unwilling to pay more

Conversely, at foodservice, the Kansas State Meat Demand Monitor reported a decline in willingness to pay for all proteins from September to October 2022. The report showed a one per cent month-over-month decline in market share for both ribeye and chicken breast at foodservice. Beef hamburger market share at food service remained steady month-over-month, with a one per cent reported increase in market share for plant-based patties and shrimp. Lunch was the main outlet for food service sales among those surveyed in the monitor, with just 49 per cent of prior-day lunchtime meals consumed at home, versus 75 per cent at breakfast and 65 per cent at dinner. Quick-service outlets maintain the largest share of breakfast, lunch and dinner.