Despite a dip in September, demand for Canadian beef has been strong in Mexico this year.

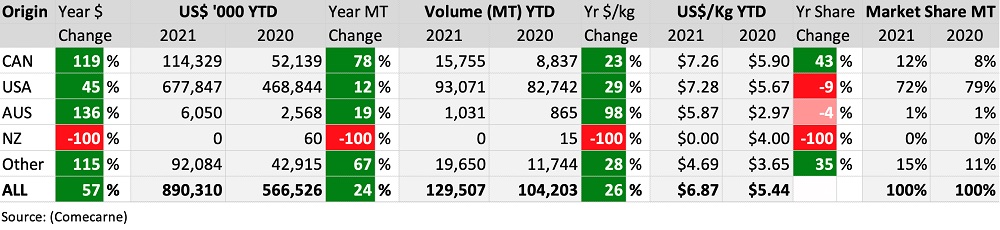

For the first nine months of 2021, the accumulated volume of Canadian exports to Mexico was up 78.3 per cent over 2020. Chilled beef exports were up 80.8 per cent over last year, with value up 120.4 per cent to US$98.43 million. Following a steady performance over the summer, exports in September did take a step back, dropping 14 per cent in volume. Month-to-month value falling 24.8 per cent, from US$18.25 million in Aug to US$13.71 million in Sept.

Read Also

Pen riders still better than tech at detecting respiratory disease in feedlot cattle, says researcher

Recent research found that pen riders are better than tech at flagging signs of BRD in feedlot cattle

Overall beef imports have risen in Mexico as well. During the first nine months of 2021, Mexico imported 129,507 tonnes of beef, 24.29 per cent more than in 2020. The value amounted to US$890.3 million, a considerable increase of 57.15 per cent year-over-year.

Retail sector

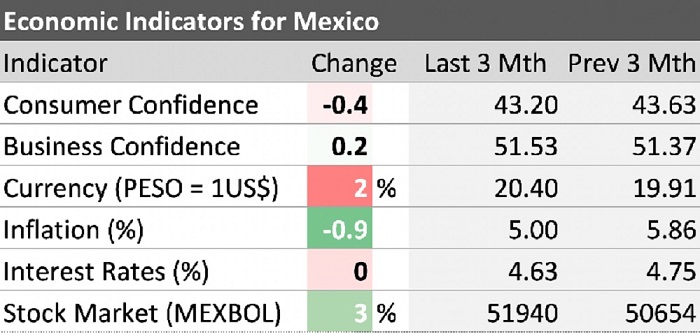

In September 2021, beef prices in Mexico rose more than 14 per cent annually, more than four times the rise in the same period from 2019 to 2020. The increase is due to the effect of grain costs and consequences of poor weather.

In September 2021, Mexican domestic retail beef prices were:

- sliced round (US$9.17/kg)

- ground beef (US$6.28/kg)

- top sirloin (US$9.10/kg)

- chuck (US$8.94/kg)

- tenderloin (US$20.48/kg)

Some of the main producers/distributors of food in Mexico are preparing to boost the consumption of alternative meat products in the country. A startup specializing in developing products to substitute ingredients of animal origin is already working closely with this sector to promote veggie burgers.

However, large retailers are also following post-pandemic consumer trends and promoting high-quality and innovative differentiated products, including groceries and beef.

Food Service Sector

Although the hotel and restaurant sectors have shown improvement since 2020, these sectors won’t reach 2019 levels until at least 2023. The Mexican population’s eagerness to return to social life will allow the restaurant sector to recover faster than the hotel industry.

Advancements in vaccination rollout have been a source of trust for people to go out and return to economic normality. Although home delivery is still a major income source for restaurants, people are returning to the sit-down dining experience. Holidays, festivals such as “The Day of the Dead” Black Friday, F1 Racing and the upcoming Christmas season are some of the major activities that will allow for a faster reactivation. The National Restaurant Chamber is developing nationwide campaigns to promote food created by chefs from different states and municipalities.

The tourism market’s road to recovery in the capital and in most cities is still in progress due to intermittent restrictions, higher inflation rate, more virtual meetings and lack of personnel. In contrast, hotel occupancy at beach destinations has seen a 20 per cent growth in the last quarter.

Import/Distribution

Beef imports into Mexico during September totalled 129,507 MT. The U.S. holds a 68.5 per cent volume market share, Nicaragua 17.9 per cent and Canada 12.2 per cent. September imports from U.S. beef were 14.3 per cent below the previous month’s volume and down 2.65 per cent year-over-year. Value for U.S. imports also slipped 12.92 per cent from the previous month, to US$82.64 million in September 2021.

The US Department of Agriculture suspended live Mexican cattle imports until new rules and certifications were implemented. The measure affected 11 exporting states which had to sell their cattle in the domestic market at a lower price. Higher inflation rates and a drop in pork prices in Mexico have represented new challenges for beef consumption.