The industry needs to keep an eye on the retail price of beef in the next year, says a market analyst.

Brenna Grant, executive director of Canfax, spoke about the direction cattle markets are likely headed while at the Canadian Beef Industry Conference (CBIC) in Penticton, B.C. earlier this summer. Retail prices were a focus of her presentation.

“Where we get challenged is when our price relationship with pork and poultry gets out of whack. And we then see incentives for the consumer to switch between proteins,” says Grant.

In the first quarter of 2022, Grant says beef retail prices were at record-high levels. This means some consumers were to make the shift to pork and poultry.

Read Also

Pen riders still better than tech at detecting respiratory disease in feedlot cattle, says researcher

Recent research found that pen riders are better than tech at flagging signs of BRD in feedlot cattle

“As prices came down in the second quarter, we saw things come back into line with pork or poultry, but they still remain elevated compared to historical price relationships with poultry,” Grant says. “So we would expect that if that continues that we would see more switching towards poultry throughout the rest of this year.”

In an interview, Grant said that retail prices should stabilize moving forward.

“There’s been a lot of volatility in the market, there’s been a lot of food inflation. But as we see, cost structures adjust through the supply chain,” she says. “There’s not a lot of room for them to come down further. Retailers have had their margins squeezed to be negative in the last two years. And some of these price adjustments will allow them to get back in the black.”

Another issue raising beef prices is the supply available to consumers. In 2021, Canada was a net importer of beef. Now, they are a net exporter, with Grant saying that around 4,000 head have been exported in the first half of 2022.

Because of all these exports, supply has tightened for beef consumers.

“So with this really strong net beef trade with large exports and somewhat smaller, steady imports, and our production being relatively steady, we’re actually looking at net beef supplies available to the Canadian consumer being the tightest since 2015,” Grant says.

Going forward, Grant says this isn’t likely to change.

“Basically, our domestic reproduction is going to be relatively stable,” she says. “Tighter supplies — particularly for Canada — are really coming from net trade, stronger exports and steady to more imports that really are just making less tonnage of beef in the Canadian market.”

Duane Lenz with Cattlefax also presented at CBIC regarding the global beef market and its outlook for the remainder of 2022.

He says the high retail prices are a worldwide phenomenon, but one producers might not have to be so concerned about.

“We all think that retail prices here in Canada and the United States are too high,” Lenz says. “At the same time, somebody in China will buy it at our existing price and ship it halfway around the world. And they’re glad to have it. So when you add with a delivery cost, so to speak, everything’s going quite well.”

Grant adds that total beef production this year is up by about two per cent. She says the main thing producers should be aware of is that cattle prices may climb in the fall.

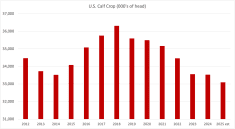

“The big thing is that there is upward price potential for this fall, as we see the prices come down. And as we go into 2023, we are going to be in a tighter North American supply situation, which is going to be price supportive.”