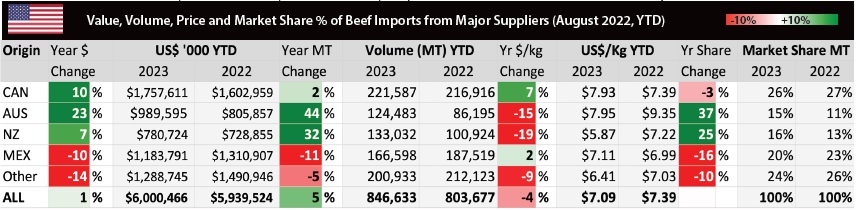

U.S. import volumes of Canadian beef and veal rebounded in July, after three months of declines. July imports totalled 83.6 million pounds (37,929 tonnes). Carcass weights were up 14 per cent from June and up a moderate six per cent from July 2022. U.S. imports of Canadian beef are up seven per cent from the five-year average.

Reduced domestic production is limiting exports and encouraging imports. Beef import volumes rebounded eight per cent in July to be the fourth-highest July volume going back to 2002.

According to a recent survey conducted by Purdue University, most Americans indicated that beef is superior to either plant-based or lab-grown proteins from several standpoints, including taste, nutrition and environmental impact. A survey conducted by the Kansas State Meat Demand Monitor found that approximately 37 per cent of physically active individuals are intentionally consuming protein to help with their fitness.

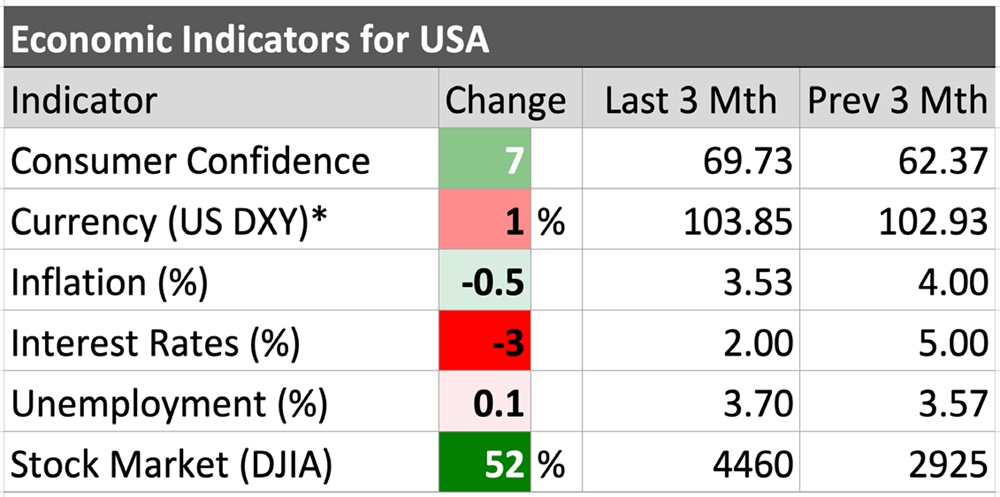

The Consumer Sentiment Index in September fell to 67.7, down 1.8 from August. Consumer sentiment has steadily turned negative over the summer. The inflation rate for August 2023 is pegged at 3.7 per cent, the second consecutive increase in inflation this year. Increases in oil prices and transportation have driven inflation. Core inflation rate (excluding food and energy) decreased 0.4 per cent to 4.3 per cent, in line with market expectations.

Read Also

Cattle Market Summary

Break-evens, cow and calf prices, plus market summaries courtesy of Canfax and Beef Farmers of Ontario. Cost of Production October…

Retail prices jump in July

The August all-fresh retail beef price was steady with the month prior at US$7.82/lb (US$17.24/kg) and is up 6.8 per cent year-over-year. A significant jump occurred in July, when all-fresh beef prices climbed three per cent to US$7.79/lb. The latest Kansas State Meat Demand Monitor shows that retail demand was largely softer between July and August. Retail demand for ground beef, pork chops, bacon, and chicken breasts were down one to four per cent. The exception was ribeye steak, jumping five per cent between June and July and another two per cent between July and August.

Retail beef prices (average of all cuts) in August were steady with July and up six per cent from August 2022 to average US$7.32/lb (US$16.14/lb). In contrast, retail pork prices increased two per cent to US$10.75/kg, and chicken retail prices increased one per cent to US$4.86/kg between July and August. Retail pork prices are steady from a year ago; retail chicken prices have fallen three per cent.

Meat price ratios affect consumers at the grocery store, as most consumers see beef, pork and chicken as direct substitutes. The beef-to-pork ratio was 1.5:1 in August. The beef-to-chicken ratio was 3.32:1. Since August 2022, the beef-to-pork ratio has been in a tight 1.38-1.53:1. The beef-to-chicken ratio has been in a wider 3.01-3.36:1. Retail price ratios are near the high end of the range but remain relatively stable.

Demand rises in food service sector

Eating and drinking places saw solid growth in August, as consumers remained positive. Total nominal sales increased 0.3 per cent, to be the sixth consecutive month of sales growth.

Consumers indicated that they aren’t eating out, or ordering takeout or delivery as often as they would like, suggesting at least moderate pent-up demand among consumers.

The Kansas State Meat Demand Monitor showed that demand increased for all five meat protein products reported on. For away-from-home meals, consumers chose to eat on the run for breakfast and lunch; but chose to enjoy their dinner at a more leisurely pace. Quick service accounted for 39 per cent of breakfast meals in August. Quick service was also the top choice for lunch meals at 27 per cent. Casual dining accounted for the largest number of dinner meals, at 32 per cent of all meals, steady with July.