Chicago | Reuters –– U.S. seed and agrochemical companies Monsanto and DuPont said on Thursday they have signed a multi-year supply agreement for the weed killer dicamba in the U.S. and Canada.

Under the deal, whose terms were not disclosed, Monsanto will supply its farm seeds and chemicals rival with the herbicide, which will be sold as DuPont FeXapan herbicide plus VaporGrip Technology, the companies said.

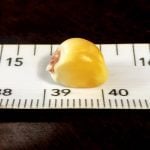

The chemical is meant for use with Monsanto’s Roundup Ready 2 Xtend soybeans, a genetically modified variety designed to tolerate applications of dicamba and glyphosate herbicides. DuPont signed a licensing agreement in 2013 to incorporate Monsanto’s Xtend trait in its seeds.

Read Also

Pulse Weekly: Talk arises of India ending duty-free period

With harvest underway across the Canadian Prairies rumblings has been felt from the other side of the world, specifically in regards yellow peas. There have been recent media reports stating the Indian government is under growing domestic pressure to end its duty-free period on yellow pea imports.

Widespread planting of glyphosate-tolerant corn, soybeans and cotton in the U.S. has contributed to the rise of weeds resistant to the herbicide so farmers are seeking alternative varieties that can withstand other weed killers.

Monsanto has invested more than $1 billion in a New Orleans-area dicamba production facility to supply demand it expects will blossom in the coming years (all figures US$). The company has said the Xtend platform will be its largest-ever technology launch.

The Xtend soybean trait was planted on around one million acres in the U.S. this year, less than initially planned due to import-approval delays in the European Union. Monsanto expects 15 million acres to be planted with Xtend soybeans next season and 55 million acres by 2019.

DuPont’s deal with Monsanto comes amid a period of heightened consolidation in the farm seeds and chemicals industry that has long been dominated by six large companies.

DuPont and Dow Chemical agreed to a $130 billion merger last year and Syngenta agreed in February to be bought by ChemChina for $43 billion. In May, Monsanto turned down a $62 billion takeover offer from Bayer but said it remained open to a deal.

— Karl Plume reports on agriculture and ag commodity markets for Reuters from Chicago.