Reuters – Canadian fertilizer and farm supplies dealer Nutrien Ltd reported a better-than-expected quarterly profit and raised its full-year adjusted profit forecast, driven by strong demand for its potash fertilizers.

The world’s largest fertilizer company by capacity raised its full-year adjusted profit forecast to the range of $2.60-$2.80 per share, from its prior estimate of $2.40-$2.70 per share.

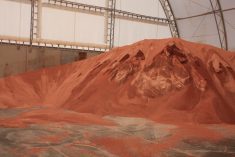

Nutrien, formed by the merger of Agrium and Potash Corp of Saskatchewan in January, said its potash volumes rose 17 percent to 3.9 million tonnes at an average realized price of $212 per tonne in the third quarter.

Read Also

Louis Dreyfus buys oilseed assets from Bunge in Poland and Hungary

Louis Dreyfus Company has acquired grains and oilseeds processing, storage and trading activities in Hungary and Poland from rival agricultural commodity merchant Bunge Global, fulfilling conditions Bunge needed to meet to get approval of its merger with Viterra.

The company reported a net loss from continuing operations of $1.07 billion, or $1.74 per share, in the quarter ended Sept. 30.

Nutrien had reported a loss of $53 million a year earlier, based on the combined results of Potash Corp and Agrium.

The company said on Monday it recorded a $1.8 billion non-cash impairment charge due to closure of its Brunswick potash facility, following a strategic review.

Excluding items, Nutrien earned 47 cents per share beating analysts’ estimates of 40 cents per share, according to IBES data from Refinitiv.

U.S rival Mosaic Co on Monday reported better-than-expected third-quarter profit and sales, boosted by higher prices and acquisition of Vale Fertilizantes. (Reporting by in Bengaluru