Pulse weekly outlook: Chickpea stocks down; lentils, dry peas up

Chickpea prices unchanged before report

Grain stocks come in as projected

StatCan report deemed neutral for canola and spring wheat, supportive for durum

Absence of issues leads to January record for grain movement

CN, CP so far see 'calamity-free' 2022-23

ICE weekly outlook: Choppy trading for canola, other oilseeds

Signals not pointing to course change for now

CBOT weekly outlook: Commodities largely rangebound after USDA report

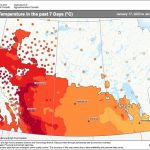

Prairies’ warmer spell to be usurped by arctic front

Prairie cash wheat: Prices step back

U.S. wheat futures down on week

AAFC issues first look at 2023-24

Oats production expected down significantly on year; wheat, canola up

Feed weekly outlook: Prices slip during quiet January

Shortages of trucks, drivers still trouble cattle sector

China driving crude oil price increases

Bulls on crude oil expect a 'very shallow' recession