Chicago Mercantile Exchange hog futures rose for a second straight day on Thursday on fund buying that sparked short-covering, traders and analysts said.

Spot-October’s discount to CME’s most recent hog index of 96.38 cents underpinned the contract. The CME stopped updating its cattle and hog indexes on Tuesday because the U.S. government is shut down.

December hogs led gains as traders bought that month and sold spot October ahead of its Oct. 14 expiration.

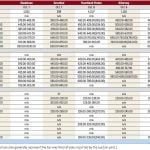

Spot October finished at 91.3 cents per pound, up 0.35 cent. Most-actively traded December closed 0.6 cent higher, at 86.775 cents (all figures US$).

Read Also

U.S. livestock: Feeder cattle hit contract highs on tight supply

Chicago | Reuters – All Chicago Mercantile Exchange feeder cattle futures and most live cattle futures hit contract highs on…

The seasonal increase in hog supplies kept a lid on cash prices, which were steady to down $1 per hundredweight (cwt) in terminal and direct hog markets, sources said.

Packers on Thursday processed an estimated 432,000 hogs, up 1,000 from last week and steady with a year ago, according to analytical market research firm Urner Barry.

Cash hog buyers look for packers to slaughter about 50,000 hogs on Saturday.

Bob Brown, an independent market analyst, said lower hog prices likely pushed packer margins further into the black. But, calculating that margin is difficult without U.S. Department of Agriculture cash hog and wholesale price data, he said.

Livestock futures trading volume has declined this week as bullish and bearish investors have been cautious in the absence of price information while the U.S. government is shut down.

Speculative traders bought deferred CME hogs in the belief that last Friday’s bearish USDA quarterly hog report did not account for losses from the porcine epidemic diarrhea virus

(PEDv), which is deadly to baby pigs.

Mixed live cattle trade

Live cattle futures settled mixed following a volatile session.

Texas and Kansas cash cattle sales at $126/cwt, which was steady with last week, underpinned October futures. Later trades at $125 in Nebraska, steady to $1 lower than a week ago, pressured the December contract.

The Nebraska cash news may have been viewed as negative for some of the back months that were at a significant premium to cash, a trader said.

Packers resisted paying higher cash prices due to negative operating margins. Recent declines in slaughter have pushed up wholesale beef values.

Thursday’s wholesale choice beef price, or cutout, was up 72 cents/cwt from Wednesday at $192.33. The select price climbed $1.03, to $176.23, as calculated by Urner Barry.

October cattle futures closed up 0.125 cent at 127.425 cents/lb. while December finished down 0.05 cent at 131.775 cents.

Profit taking and weak deferred live cattle futures pulled down CME feeder cattle.

October feeder cattle ended 0.475 cent/lb. lower at 164.1 cents. November settled at 165.625 cents, down 0.575 cent.

— Theopolis Waters reports on livestock futures markets for Reuters from Chicago.