While many crops across Western Canada are withering under intensifying drought, Agriculture Minister Gerry Ritz says ad hoc programs are not the answer should producers require assistance. However, tax deferral will be available for affected ranchers.

“We don’t need ad hoc (assistance), we’ve got a very comprehensive system of business risk management,” said Gerry Ritz, speaking in Winnipeg last week. “There’s four different pillars in that, and of course crop insurance is first and foremost the first line of defence.”

AgriStability will also be able to assist producers, said Ritz, noting that the five-year incoming averaging period the program relies on is designed to stabilize farm returns in years where production or profit fall due to poor weather or other factors beyond producers’ control.

Read Also

Pulse Weekly: Yields coming into focus

Provincial agricultural departments are reporting pulse yields higher than Statistics Canada’s September estimates.

“The closest thing that I would consider along with the ministers that are affected — we’ve had this discussion in Charlottetown as late as late week — would be AgriRecovery,” he said.

Tax deferral

Ritz noted that crop insurance has also been expanded to include pastureland and forages, both of which have been affected by a lack of rainfall in many areas of Western Canada.

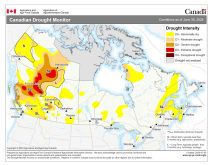

Southern Manitoba has largely been spared from dry conditions, with many areas receiving relatively normal precipitation. However, farther north and in areas like Dauphin, Gilbert Plains, Alonsa, Mossey River, Roblin and Ochre River the situation has been severe.

Ranchers in those regions will eligible to apply the Livestock Tax Deferral Provision, announced by Minister Ritz on July 23.

The designation allows livestock producers facing feed shortages in prescribed drought regions to defer a portion of their 2015 sale proceeds of breeding livestock for one year in order to help them replenish stock the following year. Proceeds from deferred sales will be included as part of the producer’s income in the next tax year.

To defer income, the breeding herd must have been reduced by at least 15 per cent. If this is the case, 30 per cent of income from net sales can then be deferred. In cases where the herd declines by 30 per cent or more, 90 per cent of income from net sales can be deferred, according to Agriculture and Agri-food Canada.

“This tax deferral will provide producers with the flexibility they need to make decisions in the best interest of their individual operations,” said Ritz. “We want to assure producers that are caught in this, that what they need will be delivered in a timely manner.”