Winnipeg | Reuters — Fertilizer producer Mosaic Co. does not currently see the right market conditions to restart its idled Saskatchewan potash mine, with high inventories in the U.S. and Brazil and cold weather slowing trains from Canada, CEO Joc O’Rourke said Wednesday.

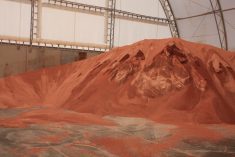

Mosaic curtailed potash production in December at its Colonsay, Sask. mine, but said then that it expected to restart in early 2023.

“It’s just a matter of starting to see the inventories coming down,” O’Rourke said in a Reuters interview. “The last thing we want to do is start it up, run it for a month-and-a-half and have to shut it down again.”

Read Also

U.S. grains: Soybeans fall as hopes for Chinese demand wane; corn, wheat firm

Chicago soybeans fell on Monday after hitting two-month highs on Friday, as industry players lost confidence that Chinese buyers would purchase U.S. soybeans, while dealers assessed exemptions granted to U.S. crude oil refiners for use of soy-based biofuels.

O’Rourke declined to be more specific on timing for restarting the mine, which was producing at an annual rate of 1.3 million tonnes.

“I think once we get through the first quarter, we can certainly be moving a lot more product,” he said. “But I’m being cautious about what to say until we see that movement.”

Spring is North America’s busiest time of year for potash applications.

Potash producers are banking on a return to stable prices in 2023 after disappointing demand late last year in the United States and Brazil. Potash is a key nutrient for corn and other crops, and elevated prices earlier in 2022 contributed to food inflation.

Prices had initially spiked after Russia invaded Ukraine and prompted Western countries to issue sanctions on Russia’s banking system that have slowed its potash exports.

O’Rourke said he sees strong demand this year once inventories decline.

U.S. farmers are expected to plant more corn, which consumes much fertilizer, with prices attractive.

“U.S. farmers are in really good shape,” Scotiabank analyst Ben Isaacson said. “There’s no reason we shouldn’t see at least partial recovery in potash demand, especially if we get some of the (extra) corn acres.”

A key variable is whether Russia and Belarus, another sanctioned potash producer, find ways to export more.

O’Rourke expects both will export about the same volume this year as last.

But RBC analyst Andrew Wong estimated that Belarussian and Russian potash operating rates would increase in 2023 by 10 percentage points to 50 and 80 per cent respectively of their pre-war levels.

— Rod Nickel is a Reuters correspondent covering the ag and resource sectors from Winnipeg.