Chicago | Reuters — Chicago Mercantile Exchange live cattle futures slid lower Monday, led by the prospect that packers might pay less for supplies later this week, said traders.

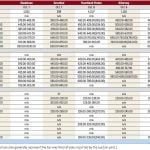

December live cattle finished down 0.85 cent/lb. at 116.375 cents, and February ended 0.8 cent lower at 121.175 cents (all figures US$).

Last week packers in the U.S. Plains paid $119-$121/cwt for slaughter-ready, or cash, cattle.

This week’s U.S. Plains’ showlist, a tally of the number of cattle for sale, has more livestock than a week ago. Packers are struggling to recoup lost margins, which could hurt cash prices.

Read Also

U.S. livestock: Feeder cattle hit contract highs on tight supply

Chicago | Reuters – All Chicago Mercantile Exchange feeder cattle futures and most live cattle futures hit contract highs on…

And beef is not only competing with plentiful pork and poultry, but for the minds of consumers that are focused on year-end holiday gift buying, said traders and analysts.

“A larger showlist will help stack the deck in favour of lower cash cattle prices this week, said Cassandra Fish, author of industry blog The Beef.

“Boxed beef values, up at midday today, are in their last gasp, early December rally before a downtrend ensues at least until Christmas,” she said.

CME feeder cattle futures drifted lower following cash feeder cattle prices and weaker CME live cattle futures.

January feeder cattle closed down 0.375 cent/lb. at 149.95 cents.

Hogs end mostly higher

Deferred CME lean hog contracts finished higher after traders bought those months and sold December ahead of its expiration on Dec. 14, said traders.

December hogs ended 0.325 cent/lb. lower at 64.950 cents. February closed up 0.95 cent to 71.675 cents, and April finished one cent higher at 75.45 cents.

“People might be thinking we’re going to see fewer hogs beginning this spring,” a trader said.

Ultimately hogs could be hard to come by after farmers rushed them to market earlier than they had planned, prompted by initial forecasts for increased supplies moving forward.

Outside of holiday ham business, and pork bellies being stored for spring and summer use, overall wholesale pork demand usually tapers off in December, the trader said.

— Theopolis Waters reports on livestock markets for Reuters from Chicago.