Chicago | Reuters — Chicago Mercantile Exchange live cattle futures ended slightly lower on Thursday, pressured by expectations of lower cash trade, and weaker wholesale beef prices, traders said.

Beef packers will be reluctant to pay higher prices for cattle in the cash market as wholesale beef prices come off recent highs and their profit margins get squeezed, traders said.

Many investors expect cash prices to be lower than last week’s trade of $145 per cwt in Texas and Kansas. There were very light sales earlier this week in the U.S. Plains at $141 to $142.50 per hundredweight (all figures US$).

Read Also

Klassen: Cash feeder market divorces from futures market

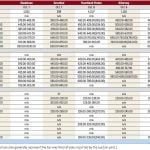

For the week ending October 11, Western Canadian yearling markets traded $8/cwt higher to $5/cwt lower compared to seven days…

On Thursday bids stood at $139 to $140 in Kansas, with no bids yet reported in Texas, feedlot sources said.

According to USDA data, the afternoon wholesale choice beef price was at $214.37/cwt, down $2.27 from Wednesday and $16.38 lower than a week ago. Select cuts were at $214.80/cwt, down $1.83 and $14.99 less than a week ago, the data showed.

Beef packer margins on Thursday fell deeper into the red to a negative $77.75 per head from a negative $52.90 per head on Wednesday, compared with a positive $15.40 per head a week ago, according to HedgersEdge.com.

Cargill said its beef processing plant in Schuyler, Nebraska, was closed early on Thursday due to a fire and an ammonia leak. The plant processes about 5,000 head of cattle per day and it was not known when operations would resume, the company said. [Related story]

The plant’s downtime contributed to a reduced overall slaughter on Thursday. USDA estimated the cattle slaughter at 111,000 head, down from 117,000 a week ago and 120,000 a year ago.

February live cattle ended at 139.55 cents per pound, down 0.15 cents. April ended at 139.075 cents, down 0.025 cents.

CME feeder cattle futures ended firm, supported by soft Chicago Board of Trade corn prices.

March ended at 167 cents/lb., up 0.075 cent, and April ended at 167.8 cents/lb., up 0.15 cent.

Hogs end mixed

CME lean hog futures ended narrowly mixed on Thursday, pressured by profit-taking a day after climbing more than one per cent, while firm cash hog prices lent some support, traders said.

Hog futures have rallied in recent days due to an anticipated reduction of hog supplies in the spring and summer months due to the spread of a deadly piglet disease, porcine epidemic diarrhea virus (PEDv), said Craig Turner, commodities broker at Daniels Trading.

“Since there’s no fresh news on that front there seems to be a bit of profit-taking in the back months,” Turner said. [Related story]

Hog movement resumed but was still slow a day after a winter storm dumped several inches of snow around the U.S. Midwest and Plains regions.

Continued cold temperatures and snow packed roads limited hog trade as cash prices firmed, a CME floor trader said.

The average price of hogs in the Iowa-Minnesota market on Thursday morning rose 14 cents from Wednesday to $$82.69, according to USDA data.

February hogs closed at 86.5 cents/lb., up 0.05 cent. April ended at 94.2 cents/lb., down

0.025 cent.

— Meredith Davis reports on livestock commodity futures for Reuters from Chicago.