Chicago | Reuters — Chicago Mercantile Exchange lean hog futures settled higher on Thursday, and the July contract notched fresh highs, supported by their discounts to cash prices and fund buying prior to the U.S. Department of Agriculture’s neutral quarterly hog report, said traders.

USDA’s report showed a record number of hogs for the March-May period, but the results were within analysts’ forecasts.

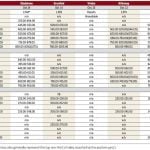

July ended 1.55 cents/lb. higher at 89.475 cents, and hit a fresh high of 89.65 cents (all figures US$). August finished 1.275 cents higher at 80.75 cents, and above the 20-day moving average of 80.378 cents.

Read Also

U.S. livestock: Cattle fall sharply as Trump says he’s working to lower beef costs

Chicago cattle futures fell sharply on Friday after U.S. President Donald Trump said his administration was working to lower the…

Hog futures received an added boost from surprising cash price strength, despite plants scheduled to close during the U.S. Fourth of July holiday.

Solid profits for packers motivated them to line up hogs for what could be a big post-Saturday holiday slaughter, a trader said.

Retailers may buy small amounts of pork until they determine how much of it moved during the holiday, he said.

Mainly higher live cattle

Most live cattle contracts at the CME gained, led by technical buying and futures’ discounts to initial cash prices, said traders.

They said positioning as the holiday and the end of the quarter draw near contributed to advances.

June, which will expire on Friday, closed down 0.05 cent/lb. to 120.2 cents. Most actively traded August ended 0.875 cent higher at 116.5 cents, and above the 10-day moving average of 116.05 cents. October finished 1.325 cents higher at 114.975 cents.

On Thursday, a small number of market-ready, or cash, cattle in the U.S. Plains brought $119-$120/cwt, compared with $118-$123 last week, said feedlot sources.

Packing plant holiday shutdowns and seasonally slumping wholesale beef demand weakened most cash returns so far this week, said traders and analysts.

Market bulls believe impressive packer profits and fewer animals for sale than last week might underpin prices for unsold cattle.

Technical buying, buy stops and live cattle futures advances lifted CME feeder contracts for a second straight session.

August feeders ended 0.775 cent/lb. higher at 147.175 cents.

— Theopolis Waters reports on livestock markets for Reuters from Chicago.