Chicago | Reuters — U.S. lean hog futures plunged on Thursday, with the five most actively traded contracts settling down the daily three-cent-per-pound limit after weekly U.S. export data showed no new pork sales to China, traders said.

Live cattle and feeder cattle futures on the Chicago Mercantile Exchange also declined, pressured by long liquidation and softening beef prices.

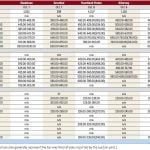

CME lean hog futures tumbled after the U.S. Department of Agriculture said export sales of U.S. pork in the week to April 18 totaled 15,500 tonnes, but included no new sales to China. In fact, China canceled sales of about 200 tonnes.

Read Also

U.S. livestock: Feeder cattle hit contract highs on tight supply

Chicago | Reuters – All Chicago Mercantile Exchange feeder cattle futures and most live cattle futures hit contract highs on…

“In hogs, it’s the export sales today,” Don Roose, president of Iowa-based U.S. Commodities, said of the sell-off in futures.

“The market got a little too enthusiastic. With record supplies of (U.S.) hogs coming at us, we know we have to have this strong demand underneath the market,” Roose said.

Traders have been expecting that China, home to the world’s largest hog herd, will need to import more pork from the U.S. and other suppliers because of an outbreak of a fatal hog disease, African swine fever.

The spread of the disease across China helped lift CME June hog futures to a contract high on April 5 of 99.825 cents/lb. (all figures US$).

But the market has since failed to match that mark, even after USDA last week reported China bought 23,473 tonnes of U.S. pork in the week to April 11, its third biggest purchase in records dating to 2013.

CME June lean hog futures on Thursday settled down the three-cent limit at 89.775 cents/lb., a 3-1/2 week low.

The CME Group said the daily limit in lean hogs for Friday’s trade would expand to 4.5 cents.

Live cattle futures fell Thursday for a fourth straight session on weaker values for cash cattle and soft beef prices. Cash cattle traded this week at $126-$127/cwt, traders said, down roughly $2 from last week.

Wholesale beef prices declined on Wednesday and Thursday, with choice boxed beef last quoted at $232.96 per cwt, down three cents, and select cuts down 53 cents at $219.75, according to USDA.

“This is the strongest time of the year for demand for beef. It’s grilling season. But boxed beef was down yesterday; that wasn’t a good sign,” Roose said.

Commodity funds hold sizable net long positions in CME live cattle, feeder cattle and lean hog futures, leaving all three markets vulnerable to bouts of long liquidation.

CME June live cattle futures settled down 2.975 cents at 115.375 cents/lb., dropping below its 200-day moving average. August live cattle futures closed down 2.9 cents at 112.925 cents/lb.

August feeder cattle tumbled 3.475 cents to end at 153.25 cents.

— Julie Ingwersen is a Reuters commodities correspondent in Chicago.