Chicago | Reuters — Chicago Mercantile Exchange live cattle futures closed mixed on Monday, helped by last Friday’s steady-to-better cash prices but pressured by profit-taking on the last trading day of the month, traders said.

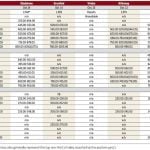

The February contract, which expired on Monday at noon CT, closed up 1.95 cents/lb. at 139.5 cents (all figures US$).

April, the new spot month, ended down 0.025 cent/lb. at 136.975 cents and June finished up 0.225 cent at 126.175 cents.

Market participants await the sale of market-ready, or cash, cattle later this week. Packers last week paid $133 to $137/cwt, steady to up $3 from the prior week.

Read Also

U.S. livestock: Cattle fall sharply as Trump says he’s working to lower beef costs

Chicago cattle futures fell sharply on Friday after U.S. President Donald Trump said his administration was working to lower the…

Last week’s cash prices benefited from tight supplies and the recent upswing in wholesale beef values, traders said.

They said some processors this week will curb slaughters to recover lost margins and sustain brisk wholesale beef demand.

The morning’s wholesale choice beef price advanced 18 cents/cwt from Friday to $217.85. Select cuts rose 93 cents, to $212.92, the U.S. Department of Agriculture said.

Weak back-month live cattle futures pressured CME’s March feeder cattle contract, with other months supported by firm cash feeder cattle prices.

March closed 0.5 cent/lb. lower at 158.15 cents. April ended up 0.225 cent to 159.075 cents and May finished 0.65 cent higher at 158.05 cents.

Hog futures finish lower

Profit taking and a potential cash price top pressured CME lean hogs, traders said.

April closed 0.875 cent/lb. lower at 69.975 cents, and May finished down 0.325 cent/lb. to 76.6.

Monday morning’s average cash hog price in the western Midwest fell $2.49/cwt from Friday in light volume to $64, USDA said.

Late last week’s cash price slump suggests they probably peaked at that time with adequate supplies, said James Burns, president of JBS Trading Co.

Closely watched was Monday’s estimated 404,000 head kill. It was down 33,000 from last week and implies a plant was offline for maintenance or processors reduced slaughters to improve their profits.

“Packers get a bit nervous and consider cutting kills when their margins approach $10 after being over $40 a few months ago,” a Midwest hog dealer said.

HedgersEdge.com estimated average pork packer margins for Monday at $17.75 per head, up from $14.40 on Friday and down $18.55 last week.

— Theopolis Waters reports on livestock markets for Reuters from Chicago.