Fed Cattle

Seasonally tight supplies in North American coupled with good beef demand have supported the summer market thus far. As fall approaches, typically market-ready supplies increase and fed prices are pressured lower, however feedlots are current, which offers some selling leverage. As well, export potential resulting from tight supplies and interest from the U. S. could limit the downside as we move through the third quarter. Looking into the fourth quarter, supplies should tighten further, strengthening beef prices as retailers look toward winter and holiday sales.

Read Also

Cattle Market Summary

Break-evens, cow and calf prices, plus market summaries courtesy of Canfax and Beef Farmers of Ontario. Cost of Production September…

Feeder Cattle

By mid-August with volumes picking up, yearling prices were expected to hit their seasonal highs within a few weeks. Where they go from here will depend on the volume of yearlings coming off grass. Demand is strong for the small number of yearlings remaining outside of U. S. feedlots, and this U. S. interest should provide a solid floor to the market through the grass yearling run. Plenty of available pen space in U. S. lots also lends support to prices.

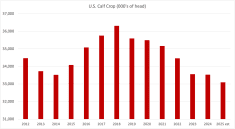

As the fall calf run begins this year pasture conditions in many areas are conducive to extending the grazing season so the bulk of the calves may be spread out over the season. The shrinking calf crop across North America lends further support to prices.

As always, during the fall run buyers keep one eye on the changing harvest conditions and other trade considerations for indications of their future cost of gain. The Russian wheat-export ban, for example, has already increased some grain prices. With interest and support expected to come from U. S. buyers for the fall run, the exchange rate is another factor to watch.

Non-fed cattle

Typically cow prices start to trend lower towards the end of August or the start of September. The past four years this downtrend began in mid-August, however, good grazing conditions in many areas will keep the cows out on grass longer and support prices this time around. The tight supply of utility cows in the U. S., the larger slaughter numbers in recent years coupled with constant demand for grinding beef suggest the drastic price change we’ve seen in other years will not be in the cards this time around.