In my weekly coverage of the U.S. beef industry, I regularly report on key supply and demand factors, and so I thought it would valuable to outline the latest fundamentals.

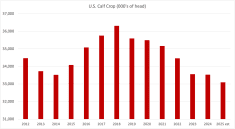

First and foremost, remember that the U.S. cattle population is the smallest since 1951. The January 1, 2025 herd total of 86.662 million head was down 0.6 per cent from 87.175 million head. But the big difference between 1951 and 2024 is that 1951 produced 8.1 billion pounds of beef, versus 27 billion pounds last year.

Last year was the sixth of herd liquidation, with a decline of more than eight million head. But as of early July, the cattle-on-feed total each month has remained close to last year. The June 1 total was 11.442 million head, 98.8 per cent of a year earlier. Slower-than-estimated feedlot marketings will keep the front-end supply above a year ago into December. Feedlots are holding cattle longer, hence record-high carcass weights for this time of year. That’s the main reason weekly slaughter rates have been mostly below 600,000 head this year. Only three weeks out of 25 have been above 600,000 head. Packers are only operating their plants five days per week.

Read Also

Factors influencing cattle feeder market during the fall of 2025

Market analyst Jerry Klassen weighs in on live cattle markets

With live cattle in strong hands, fed cattle prices reached record highs on a live basis for nine weeks in a row, right up until the week ended June 20. The five-area steer price that week averaged US$238.91 per cwt, up US$2.29 per cwt from the prior week’s record. This was up 24 per cent from the same week last year and was up US$31.21 per cwt in the nine weeks. Dressed prices averaged US$380.06 per cwt, down US$0.28 per cwt from the record US$380.34 per cwt of the prior week. But the price was up 24.4 per cent from the same week last year.

New World screwworm looked like it was significantly affecting feeder cattle supplies from Mexico this spring. A new ban on Mexican cattle imports, implemented May 11, was forecast to boost live cattle prices in the summer when they normally decline. The new ban began after reports that the disease was spreading north from southern Mexico. Well over a million Mexican feeder cattle entered the U.S. in 2024, with most going to Southern Plains feedlots. However, Agriculture Secretary Brooke Rollins announced on July 1 that cattle, bison and equines from Mexico will once again be eligible to enter the U.S. through a phased reopening of risk-based ports beginning as early as July 7.

The downturn in herd size has been due to lingering drought, high input costs (including borrowing costs to finance heifer retention), the increasing age of cattle ranchers and their risk aversion. Some modest beef herd rebuilding might begin this year because of record-high live cattle and feeder cattle prices. But ranchers will remain wary of expanding too quickly and will need to see ample green grass.

Strong demand at home and abroad for U.S. beef is the main story so far this year. The domestic market takes 87 per cent of all U.S. beef production. Retail beef prices were record-high in April. Choice beef averaged US$8.83 per pound, up 8.3 per cent from last year. The All Fresh beef price averaged US$8.50 per pound, up 6.9 per cent. Both prices eased slightly in May. Meanwhile, U.S. beef exports from January through April were three per cent below last year’s pace at 411,027 tonnes. But export value was down just one per cent to US$3.35 billion. This meant improved demand in value terms in overseas markets.

U.S. beef still faces a 32 per cent tariff in China. But the bigger impediment is that China still has not renewed the certification for U.S. beef facilities that expired in mid-March. This means most U.S. beef remains ineligible to ship to China. The U.S. Meat Export Federation estimates that the beef industry could experience a US$4.13 billion full-year impact if access to China is lost. But there has been no effect so far on U.S. cattle producers or beef demand.

Packers say they are finding new homes for beef that would have gone to China. For example, more short plates are now going to South Korea. Meanwhile, the meat export federation continues to diversify and grow markets for U.S. beef, from Central and South America to Asian nations such as Vietnam and the Philippines. Brazil and Australia are the only major beef-producing countries where herd size and production are growing.

Regarding beef consumption, the U.S. figure averaged 59.1 pounds per person in 2024 and will average 59.2 pounds per person in 2025. It won’t increase above these levels unless U.S. beef production and beef imports both increase significantly. More cattle on feed might help increase per capita consumption but the key would be more imported beef going into the hamburger trade. c