FED CATTLE

Fed cattle prices in Alberta increased steadily in the weeks leading up to mid-April. Feedlots were in a favourable position as we moved through April with a combination of tight fed supply, light carcass weights, a lower Canadian dollar when compared with a year ago and a seasonal demand that pushed fed steer averages above the $100/cwt mark. Fed steer prices have not been above $100/cwt since the spring of 2007. From the start of April Alberta fed steer prices rose nearly $5/cwt compared to the decrease that we saw in 2008. This $5 bump followed an increase of $10 throughout the first quarter of 2009.

Read Also

Feed grain update for Canadian beef producers

Factors affecting the feed grain market and what it means for Canadian cattle feeders

While Alberta fed steer averages improved by $15/cwt in the past several weeks the U. S. fed market rose less than half of that amount. That means some of our price improvement is the result of a basis shift. And in fact, the Alberta fed basis narrowed significantly in recent weeks. By mid-April it had tightened up to 6.90/cwt under the U. S. If recent history is any indication that trend could be changing this month. In the past two years the fed basis rallied in the spring, peaked in May and then widened again into the summer and fall.

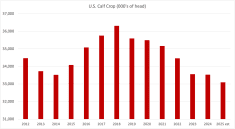

Canadian cattle on feed on April 1, 2009 totaled 947,131 head, three per cent more than were on feed April 1, 2008. Placements reflected smaller offerings at auction throughout the month. A total of 194,340 head was placed, three per cent fewer than the placements last March. The number of cattle slaughtered domestically and exported for slaughter in March reflected eager sellers in a strong spring marketplace as well as the larger number on feed this year, which were up 17 per cent at 169,629 head.

FEEDER CATTLE

Feeder cattle prices climbed higher again last month. Mid-month 550-lb. feeder steers averaged $122.73/cwt, about $21 higher than last year and about the same as the mid-April market in 2007. Lighter volumes on offer contributed to the higher prices as buyers looked to secure grass stocks. Since the start of the year the price of 550-lb. feeder steers in Alberta has increased by 24 per cent, compared to only five per cent for the same period last year.

Heavier steers held mostly steady since our last issue, but are still significantly higher than last year and the start of this year. For example, at press time 850 Alberta feeder steers averaged $99.78, which was more than $15 higher than last year, and 12 per cent above the price on January 1.

The basis remains wide, sitting near $20 under the U. S. at mid month. So far it has fluctuated mainly between -22 and -16.

Feeder cattle exports to the U. S. at the start of April totalled 143,302 head, down 32 per cent from the same period in 2008. Reduced exports have been a result of lower domestic feed costs as well as concerns of U. S. feeders about the uncertainty surrounding the COOL final rule.

NON-FED CATTLE

While cull cows have continued to come to town domestic slaughter levels are reflecting the tighter supplies. Canadian cow slaughter is down 19 per cent on the year, totaling 178,307 head. Butcher bull slaughter is also down at just 2,951 head, about half of what it was last year at this time. Prices reflected the lower supplies and constant demand for industrial beef. D1, 2 cows in Western Canada were averaging $55.66/cwt, the highest price since the spring of 2003. Exports were another contributing factor as the demand for slaughter cows and bulls shows no sign of slacking off. Exports of slaughter cows and bulls to date in 2009 reached 57,713 head, 12 per cent more than we moved to the U. S. last year at the same time.

Butcher bulls averaged just over $62.00/cwt in March.

DEB’S OUTLOOK

FED CATTLE

North American fed cattle supplies were expected to remain tight throughout April, leading into seasonally smaller May supplies. Feedlots in Canada are current which will support prices in addition to the continuation of a reduced Canadian dollar, light carcass weights and tight basis. As in past months the economy is the wild card, the seasonal demand increase seen to date in cutout values is encouraging however how far consumer demand will go is uncertain given the tough economic times.

FEEDER CATTLE

Feeder supplies at Canadian auction markets will be tight as we head into summer. Tight supplies in general support higher prices. One factor to keep in mind is that upside potential in the feeder market is limited by changes in feed costs which are volatile through spring planting as acreage estimates are made and weather factors start to play a role in the fall feed price forecasts.

NON-FED CATTLE

Slaughter cows and bulls will remain in demand throughout the summer. In a typical year demand for grinding products increases through the heat of the summer months as consumers in hot regions turn their grilling habits more to burgers and lighter meals. This year grinding and trim meats will benefit from those seasonal increases as well as the economically driven move to more inexpensive cuts. Tighter supplies both seasonally and through the summer due to the shrinking North American cow herd will also support prices. In general D1, 2 prices peak in late spring or early summer.

— Debbie McMillin

Debbie McMillin is a market analyst who ranches at Hanna, Alta.

More markets