High retail prices have made consumers question why beef is so expensive. A joint project between BetterCart Analytics and the Saskatchewan Stock Growers Association aims to provide some answers.

The project looked at pricing data in 39 different cities and a variety of different retailers within Canada. Melanie Morrison, CEO and founder of BetterCart Analytics, says this is an important topic to look into.

“There’s no time like the present really to start piecing these elements together so we can create greater transparency in the supply chain and start tracking that rancher to retail price spread,” Morrison told attendees of the association’s AGM earlier this year.

Read Also

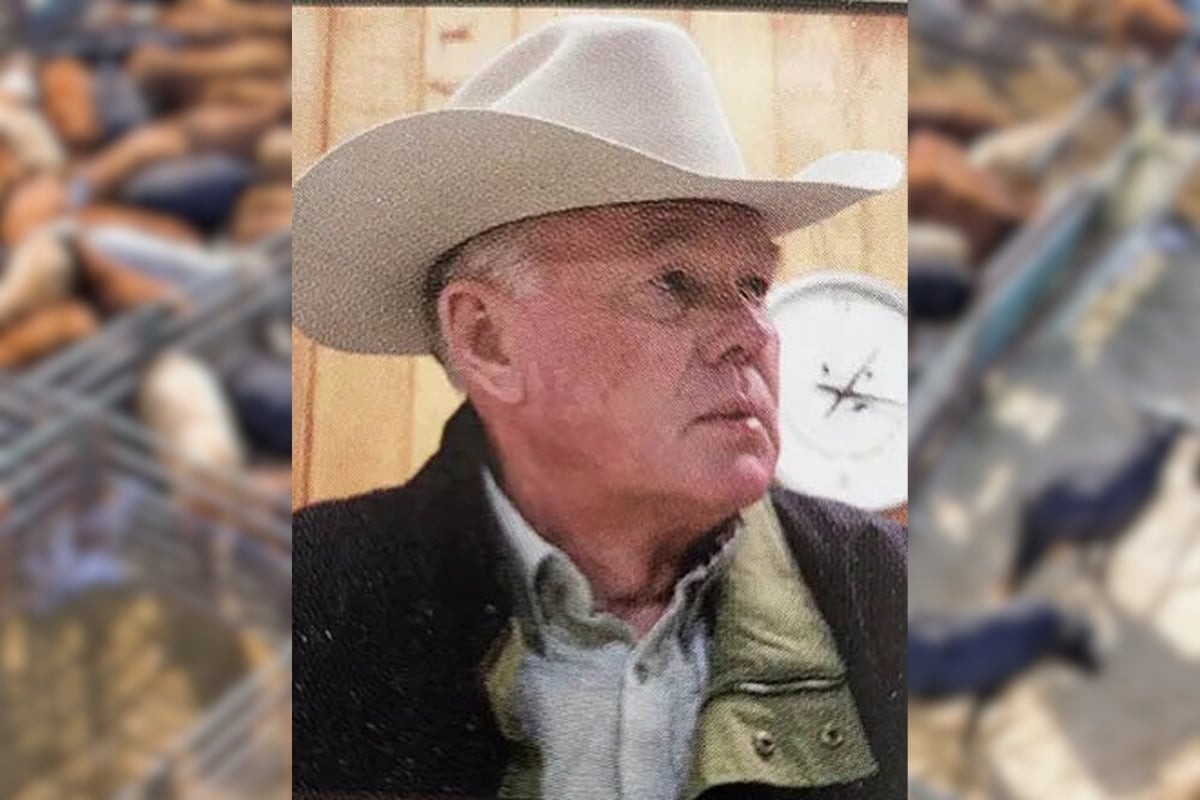

Condolences to Dennis Johnston’s loved ones on his passing

Dennis Harry Johnston of Johnston Angus at Conquest, Sask., passed away on June 6, 2025, with family by his side….

BetterCart Analytics collected data from January 2020 to March 2023 from 17 major grocery chains across the country. Morrison explains they collected around 400,000 data points on nine different beef products, which include medium, lean and extra-lean ground beef, inside, loin and other steak, and loin, pot roast and blade roasts.

From these data points, Morrison says the farm share of the retail beef dollar dropped to 41 per cent in 2022. In 1970, it was at 64 per cent. She also says the retailer share climbed from 23 per cent to 48 per cent, while the packer share remained constant.

“This is concerning,” Morrison says of the change in retailer share. “And people want to understand … so they can advocate on these issues and understand where we go from here.”

Morrison shared some of the data on pot roast retail prices during her presentation. For example, in British Columbia, Abbotsford, Burnaby, Nanaimo and Victoria had an increase of 49.75 per cent, going from $20.30 in 2020 to $30.40 in 2023. Vancouver, Surrey, Richmond, Kelowna and Kamloops all experienced a 10.43 per cent increase, with dollar amounts varying.

In Calgary, Alta., the price of pot roast per kilogram in 2020 was $20.03, but had an increase of 49.95 per cent, with 2023 being $30.04. Edmonton experienced a 50.9 per cent increase.

In Saskatchewan, Moose Jaw and Prince Albert experienced a 49.95 per cent increase, with both starting at $20.03 in 2020 and reaching $30.04 in 2023. Regina and Saskatoon experienced a 11.35 per cent increase, with prices being at $22.90 in 2020 and $25.50 in 2023.

Manitoba’s results in Winnipeg and Brandon also showed a high increase of 49.95 per cent, with prices the same as Moose Jaw and Prince Albert.

The location with the highest increase from 2020 to 2023 was Oshawa, Ont., with a 62.98 per cent increase.

“You can see that some of the cities are more elevated than others,” Morrison says.

“So the interesting thing, then, as we get a handle on the data is we are able to have these conversations with the SSGA and determine, ‘Okay, based on your expertise and knowledge of the industry, why might that be?’”

In the question and answers part of Morrison’s presentation, she was asked by a producer attending the general meeting if they had mapped any data for plant-based alternatives.

Morrison says they do have some data on the alternative meats, although she did not share it at the conference.

“This could be highly valuable as well,” she says. “Getting a little bit of different price points … and to use this data to support marketing efforts and more advocacy.”

Morrison says more analysis is required on data from specific retail chains.