Reuters — Deere and Co. on Friday raised its full-year earnings forecast after quarterly profit topped Wall Street estimates on the back of strong demand for farm and construction equipment.

The world’s largest farm equipment manufacturer now expects net income in fiscal 2021 to be between $5.7 billion and $5.9 billion, up from a range of $5.3 billion and $5.7 billion forecast in May (all figures US$). This is the third upgrade in the company’s earnings estimate in seven months.

Higher farm income following a run-up in commodity prices and the need to replace aging fleets are driving up demand for new tractors and combines.

Read Also

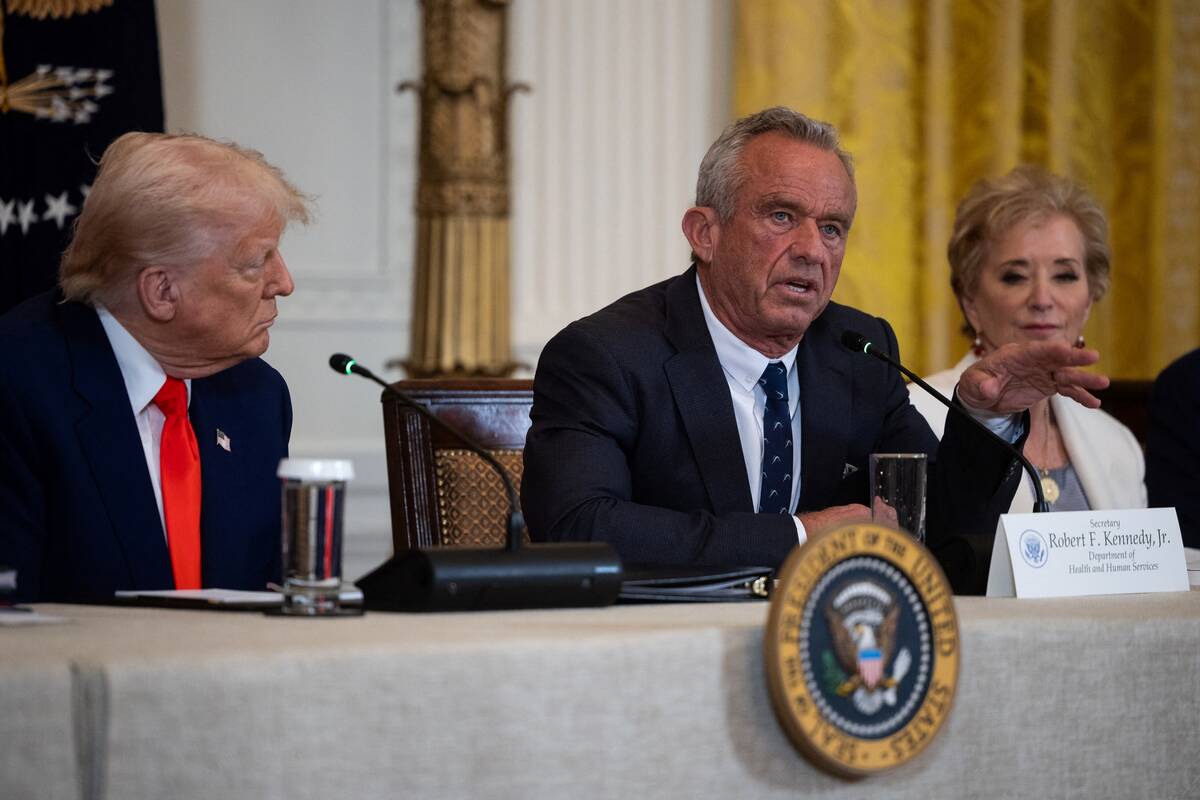

Draft ‘MAHA’ commission report avoids pesticide crackdown feared by farm groups

The White House will not impose new guardrails on the farm industry’s use of pesticides as part of a strategy to address children’s health outcomes, according to a draft obtained by Reuters of a widely anticipated report from President Donald Trump’s ‘Make America Healthy Again’ commission.

“Looking ahead, we expect demand for farm and construction equipment to continue benefiting from favourable fundamentals,” Deere CEO John May said.

The demand is booming at a time when dealer inventories are at a record low and the pandemic has disrupted the supply chain, extending the time equipment makers need to produce new orders. Big tractor makers including Deere are booking orders for delivery in 2022.

With supplies lagging demand, farm machinery companies are able to push through price increases to offset their soaring input costs.

For example, Deere’s revised earnings estimate assumes an eight per cent gain in prices for large farm machines. That compares with a six per cent price increase estimated in February.

The company also revised up the outlook for industry sales of agricultural equipment in Europe and Asia, though it left estimates for sales in the U.S., Canada and South America unchanged.

Earnings for the third quarter came in at $5.32 per share, up from $2.57 per share ago. Analysts surveyed by Refinitiv, on average, expected the company to post a profit of $4.55 per share.

Equipment sales rose 32 per cent year-on-year to about $10.4 billion.

— Reporting for Reuters by Rajesh Kumar Singh in Chicago and Sanjana Shivdas in Bangalore.