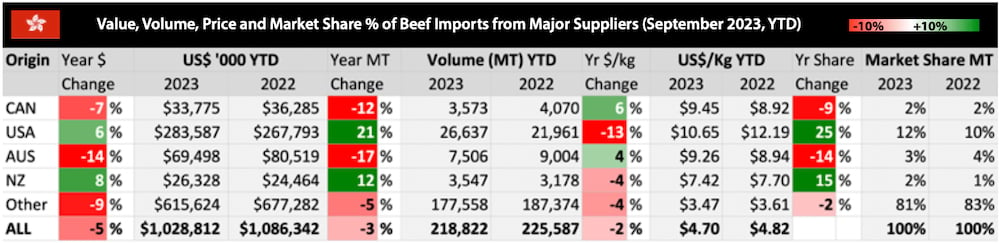

In September, Hong Kong imported a total of 218,822 tonnes of beef, reflecting a three per cent year-over-year decrease. Australian beef experienced the most significant decline at 17 per cent, followed by Canadian beef at 12 per cent. In contrast, the U.S. beef saw a notable increase of 21 per cent. When comparing overall consumer prices in September to the same month of the previous year, there was a two per cent increase, surpassing the corresponding 1.8 per cent rise observed in August.

The cost of dining out also rose by four per cent year-over-year. The Hong Kong government predicts that inflation may experience a slight uptick before the year’s end, but the annual inflation forecast for this year remains at two per cent year-over-year. The slow recovery in the food and beverage sector following COVID as well as higher Canadian beef prices versus lower U.S. and other competitor prices continues to impact the recovery and growth of Canadian beef exports to Hong Kong.

Retail sector

During the holiday season from September to October, Hong Kong experienced an influx of mainland Chinese tourists. Nonetheless this marks a 37 per cent decrease compared to the same period in 2018. This decline is attributed to factors like price disparities and high accommodation costs. Interestingly, a ‘reverse purchasing’ trend emerged, with Hong Kong residents flocking to Shenzhen, China, for more budget-friendly products.

Read Also

Factors influencing cattle feeder market during the fall of 2025

Market analyst Jerry Klassen weighs in on live cattle markets

August saw retail sales reach 32.4 billion HKD, a 13.7 per cent annual increase, slightly below the market’s anticipated 15.8 per cent growth. For the first eight months of the year, Hong Kong’s total retail sales value increased by 19.3 per cent year-over-year, with sales volume rising by 17.3 per cent. Conversely, supermarket goods experienced a three per cent year-over-year sales decline in August, followed by a 1.4 per cent decrease in sales value for food and alcoholic beverages.

Food service sector

In a bid to stimulate the market economy, the Hong Kong government has initiated the “Hong Kong’s Nightlife” program, aimed at bolstering tourist arrivals and spending capacity. Specifically targeting tourists, the initiative has been introduced, offering HK$100 dining vouchers to visitors. Consumption at endorsed eateries and bars in tourist hubs is limited to after 6 p.m., incentivizing tourists to extend their stay and giving a boost to the hotel industry.

This strategy has proven successful, resulting in a 1.6-fold increase in average daily consumer traffic compared to the previous year’s holiday season. The persisting labor shortage issue remains a focal point for the industry. Notably, over two-thirds of restaurants conducted recruitment drives in the second quarter and 86 per cent of eateries reported ongoing difficulties in recruiting personnel.