It’s hard to tell which has been tougher this year in the U.S., to be a beef buyer or running a packing plant. For the first quarter of 2014 we saw the most volatile wholesale beef market since October 2003. Beef prices have been on a roller-coaster this year. They set new record highs at the end of January, slumped in February then roared back to new record levels mid-March. This led retail and food-service buyers to call the market the most challenging they had ever experienced.

The quarter saw records set at the wholesale level for every class of beef and beef variety meat. By coincidence, the price of beef cuts, grinds, trim and byproducts set new daily records all on the same day, on March 11. The Choice and Select cut-outs each hit new record highs, as did the price of 50CL fatty trim and 90CL domestic lean beef. Not to be outdone, the daily hide and offal value hit an all-time daily high as well.

Read Also

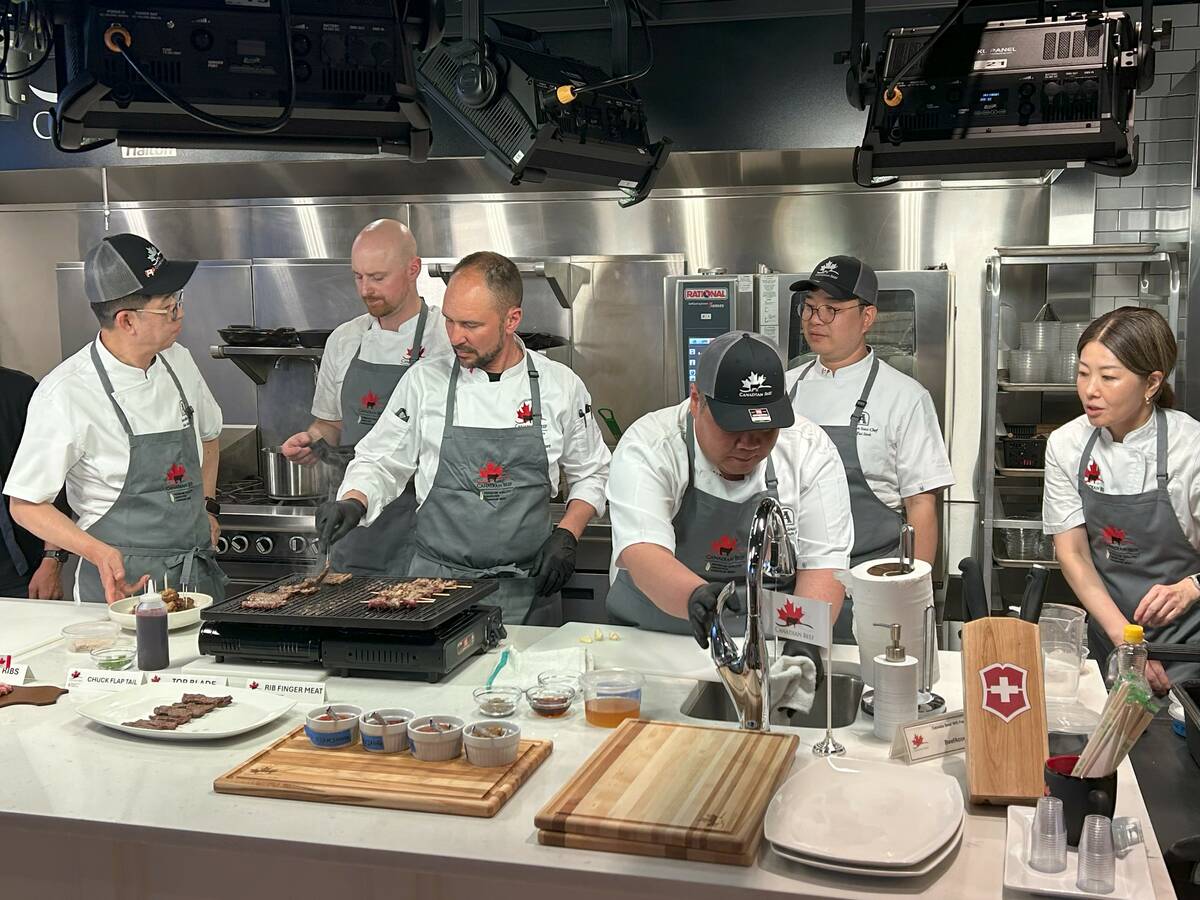

Promoting Canadian beef in Korea

Canada Beef reports on recent activities, including working with an influencer and an executive chef from Korea

Cuts, grinds and trim make up USDA weekly comprehensive boxed beef cut-out. Its trajectory so far this year reflects the volatility I mentioned. It began the year at US$201.20 per cwt but advanced to a record $229.73 by the end of January. It then slumped to $211.44 only two weeks later. But it then found new life as packers slashed their live cattle kills, and it set a new record of $233.73 the second week of March.

Meanwhile, cash live cattle prices were volatile until mid-February but prices held up better than the beef because market-ready supplies were at their tightest throughout the quarter. Ironically, the early rally in prices began in what looked like being a quiet Christmas holiday week. But packers suddenly paid a lot more for cattle (a weekly record at the time of US$134.22 per cwt).

- More from the Canadian Cattlemen: Demand heats up for available feeder cattle

Packers had clearly lost leverage over cattle feeders and prices kept moving up the next four weeks to $148.22 per cwt (basis USDA’s five-area average Choice steer price). Prices declined somewhat as wholesale beef prices collapsed but they only fell to $141.89 the week of February 14. The rally then restarted and the last week of February saw a new record price of $150.61.

Prices scarcely dipped the two weeks after that but the futures market continued to show deep discounts in the June and August live cattle contracts to March cash prices. The discounts though were reflecting a normal decline from a spring high to summer low in cattle prices.

The record-breaking beef prices understandably raised concerns about the impact on consumers’ beef purchasing. Retailers were forced to start raising their everyday beef prices in mid-February and feature less beef in March. The early February dip allowed them to book some items ahead for late March features. But the early March wholesale beef rally snuffed out prospects of much featuring after that.

One anomaly though was that packers the first two weeks of March sold product for forward delivery (22 to 90 days) at sharply lower than the spot market prices at the time. Packers appeared prepared to drop prices in the hope that live cattle supplies will increase enough in April and May to force their prices much lower.

Beef is now priced at record-high levels at both the retail, food-service and wholesale levels. Consumers have kept buying beef, with ground beef still strongly supported. Grocery stores benefited at the expense of restaurants from the harsh winter across large parts of the U.S. Beef’s real sales test though will come when spring finally arrives and Americans haul out their grills.

A North American view of the meat industry. Steve Kay is publisher and editor of Cattle Buyers Weekly.