I’ve received inquiries from cow/calf producers and backgrounders regarding the purchase of price insurance for feeder cattle. In early November the March futures made contract highs but since then have trended lower. At the same time, ther cash continues to trade near 52-week highs.

It appears the Canadian feeder market has divorced from the feeder cattle futures for the time being.

Price insurance for feeder cattle (in Western Canada) is largely based on the cost of put options on the feeder cattle futures, so producers need a good idea of the market structure for the cash and futures market to determine the most optimal period to buy price insurance.

Read Also

U.S beef industry faces demand risks and disease dangers

High beef prices and New World screwworm threaten beef demand and cattle health in the U.S.

Given the current environment, producers are finding the premium high relative to the price level being protected. This has made the program somewhat irrelevant for now. However, there will be opportunities in the future and in this article, I want to discuss a few helpful ideas so that producers have a good idea when to buy price insurance.

As mentioned earlier the program is largely based on put options for feeder cattle futures. The administrators account for exchange rate and relevant basis level to come up with the premiums and price levels.

So Canadian producers need to watch the cash market for U.S. feeder cattle. Staff at the Chicago Mercantile Exchange (CME) track the cash markets and provide a daily update. The CME composite price is the official cash settlement price for the CME feeder cattle futures at contract final settlement.

From prices reported by the USDA they calculate the seven-day average price for 650- to 849-pound feeder steers.

It’s important that producers watch this contract settlement price. In this example, notice the cash market took a rather large jump from December 28 to December 29; however, the futures market traded in a relatively sideways range and then faded the next week. The cash market was stronger but the futures market was weaker. On January 4, the January feeder cattle futures closed at $149.025. Obviously not a good time to buy the price insurance when the futures market is sharply below the cash price. Producers should wait until the futures market catches up to the cash price. Sometimes, the futures market can lead the cash market and sometimes it’s the other way round. During the delivery month, there has to a be a convergence of the cash and futures markets.

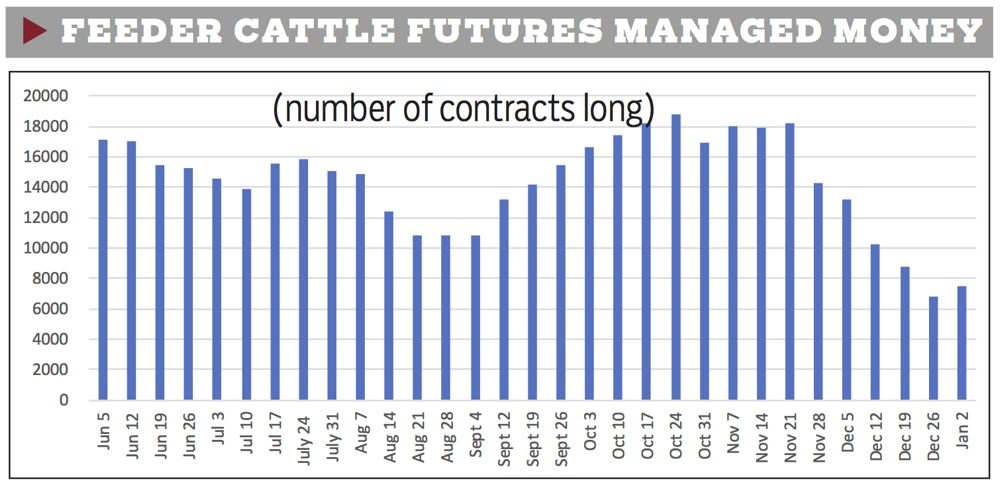

I also watch the large speculative position on the feeder cattle futures. The weekly commitment of traders report shows a breakdown of commercials which includes producers, merchants, and processors. The managed money position is the large speculator and the non-commercial is often referred to as the small speculator.

The commitment of traders report comes out every Friday afternoon and releases the positions as of the previous Tuesday’s close. Tracking the positions can be quite useful in determining when to purchase insurance. I’ve attached a chart of the “managed money” position. Notice back on October 31, the managed money was at a high for the year. On November 3, the March feeder cattle futures made a contract high of $158.925. The managed money was record long and the futures market was at a contract high.

You may not have even bought feeder cattle at this time but if you knew you were going to have feeder cattle to market in March or April, this was the time to buy some price insurance or take some price protection by placing hedges.

From December 26 through January 2, the funds have changed from net sellers to net buyers. The commercials have also been net buyers. When the commercials and the large speculative funds are on the same side of the market, this is a fairly good indication that the market has limited downside and we’ll likely see further upside. Notice the net buying by the commercials and the managed money coincides with the rise in the cash market during the last week of December.

In conclusion, cow-calf producers and backgrounding operators should be up to date with the official cash settlement price for the CME feeder cattle futures. Second, watch the net position of the large speculator (managed money) and the net position of the commercials for indications of when to insure the price of calves or feeders.