Chicago | Reuters –– Chicago Mercantile Exchange live cattle futures fell almost two per cent on Monday, their biggest daily percentage loss since early October, partly pressured by bearish fundamentals, traders said.

Sell stops and active fund selling accelerated losses that dropped December and February by their maximum three cents per pound daily price limit, they said.

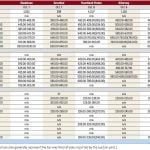

December and February settled at 161.45 cents and 161.875 cents/lb., respectively (all figures US$).

Monday afternoon’s choice wholesale beef price was down 56 cents per hundredweight (cwt) from Friday to $251.98. Select fell $1.33 to $235.36, the U.S. Department of Agriculture said.

Read Also

U.S. livestock: Feeder cattle hit contract highs on tight supply

Chicago | Reuters – All Chicago Mercantile Exchange feeder cattle futures and most live cattle futures hit contract highs on…

Beef packer margins for Monday were a negative $106.50 per head, compared with a negative $132 on Friday and a negative $106.15 a week earlier, according to Colorado-based analytics firm HedgersEdge.com.

Last week, slaughter cattle in Kansas and Nebraska sold at mostly $166 to $168 per hundredweight (cwt), down as much as $6 from the week before.

Packers are having a hard time getting grocers to buy beef at historically high levels, which could further bring down cash prices for this week, traders and analysts said.

Moderate temperatures in the central U.S. could enhance feedlot cattle performance, making more beef available to the retail sector in the near term, they said.

Still, bargain hunters are looking for futures to put in their seasonal bottom around mid-December.

CME feeder cattle futures plunged their three cents/lb. daily price limit on technical selling and live cattle market losses.

January and March ended at 231.875 cents and 228.225 cents, respectively.

Soft hog futures

CME lean hogs extended losses into a sixth straight day as traders exited December futures before it expires on Dec. 12.

Weaker cash prices pressured February that will assume lead-month duties after December expires.

Monday afternoon’s average cash hog price in the western Midwest region was down $1.28/cwt from Friday to $84.05, according to USDA data.

Most packers have all the hogs they need into the middle of the week, traders and analysts said.

Investors are eying wholesale pork demand that is competitively priced to beef, they said.

February and April slid to 3-1/2-month bottoms after falling beneath Friday’s lows, which touched off sell stops.

December closed down 0.025 cent/lb. to 86.575 cents, February 0.5 cent lower at 85.125 cents and April at 86.35 cents, down 0.6 cent.

— Theopolis Waters reports on livestock futures markets for Reuters from Chicago.