During the second week of October, southern Alberta feedlots were buying feed barley in the range of $330-$340/tonne delivered. In central Alberta, major operations were making purchases from $290-$335/tonne delivered. The barley harvest has wrapped up across Western Canada and producer selling appears to be easing. The market appears to be stabilizing at the current levels after trending lower over the past five months.

I’ve received many calls from feedlot operators asking if they should be extending coverage for their feed grain requirements. At the same time, cow-calf operators and backgrounders are wondering if higher feed grain prices will pressure the feeder market over the winter. Domestic demand will increase over the next couple of months and tends to make a seasonal high in January. However, Canadian barley exports will be down sharply from year-ago levels. November is always an opportune time to provide a fundamental overview of the barley market so producers can plan their marketing or risk management strategy.

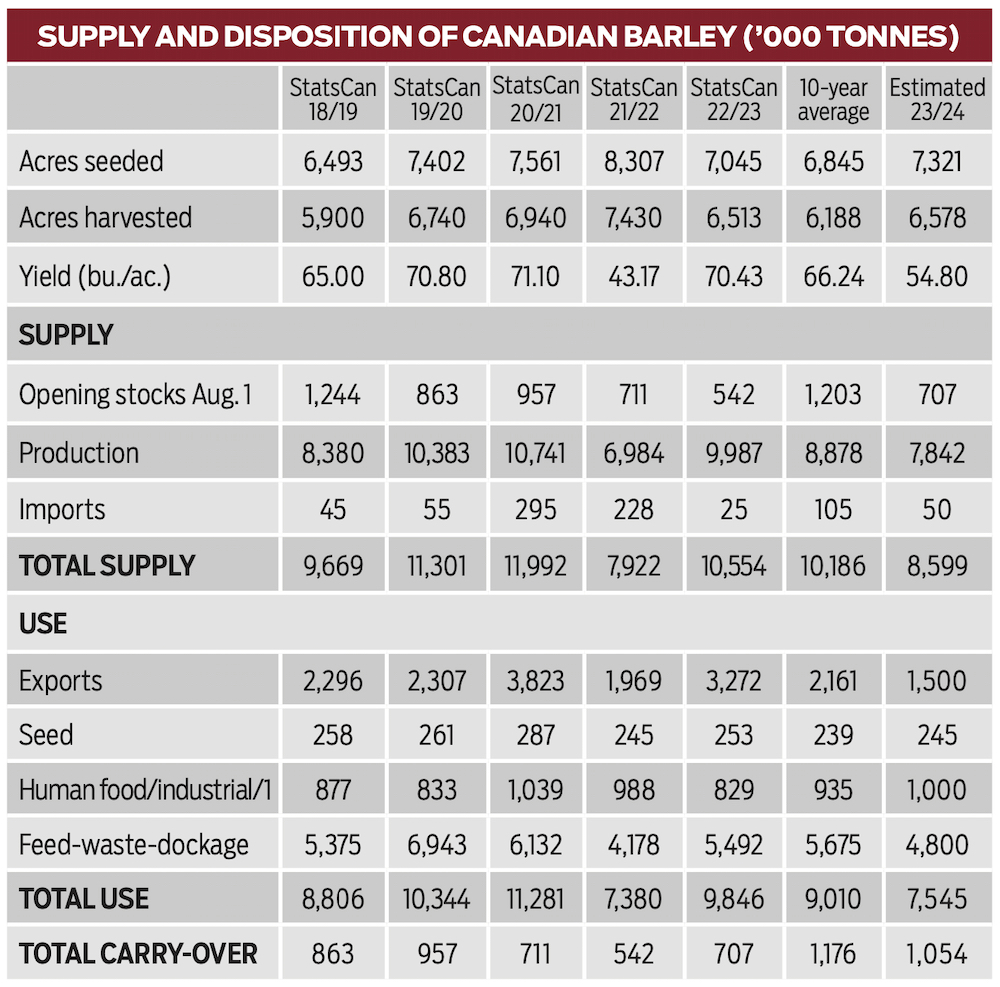

According to Statistics Canada, farmers harvested 7.8 million tonnes of barley this fall. This compares to last year’s crop size of 10 million tonnes and this is also down from the 10-year average of 8.9 million tonnes. Total beginning supplies are projected to be 8.6 million tonnes, down from last year’s starting point of 10.6 million tonnes and down from the 10-year average of 10.2 million tonnes. Barley supplies are rather tight from a historical standard. Southern Alberta and western Saskatchewan experienced a dry summer. The bulk of the barley stocks are outside the major feeding areas of Western Canada such as eastern Saskatchewan and northern Alberta.

Read Also

The Canadian Cattle Association’s international advocacy efforts

Global ag policies affect Canadian food policy, so the Canadian Cattle Association participates in international and domestic forums

When supplies are below the 10-year average, the market functions to ration demand. There are two ways in which this occurs. First, the domestic barley market trades high enough so that feedlots use alternate feed grains in the rations. At the time of writing this article, U.S. corn was trading in the range of $315-$325/tonne delivered in southern Alberta, which is about $5-$10 below barley in the Lethbridge area. Feedlots will also use wheat or oats in the rations. In early October, wheat for feed usage in southern Alberta was higher than elevator bids for offshore milling usage. The market was encouraging farmers to sell their milling wheat into domestic feed channels. I’m expecting about one million tonnes of U.S. corn to trade into Western Canada, which will result in lower demand for barley.

Second, the lower supplies cause the domestic market to trade above world values. During the second week of October, French feed barley was offered at US$217/tonne free on board (f.o.b.) La Pallice, while German barley was offered at US$212/tonne delivered Hamburg. Australian barley was quoted at US$260/tonne f.o.b. Port Adelaide. A nominal value for Canadian feed barley was US$270/ tonne f.o.b. the West Coast. Canadian barley is uncompetitive on the world market resulting in a sharp year-over-year decline in offshore movement.

It’s important to remember that during October and November 2022, barley exports were over 400,000 tonnes per month due to strong demand from China. This caused prices in central Alberta and central Saskatchewan to trade at equivalent values to southern Alberta. I’m forecasting total Canadian barley exports for the 2023-24 crop year to come in at 1.5 million tonnes. This is down from the 2022-23 exports of 3.3 million tonnes. There is very little export demand for Canadian feed barley. This year, the world’s largest barley importer has reopened their border to Australian origin, which has limited demand for Canadian barley. Barley f.o.b. Prince Rupert is significantly higher than that of French origin.

We’re projecting a Canadian barley carryout of 1.1 million tonnes, which is up from the 2022-23 ending stocks of 708,000 tonnes and similar to the 10-year average. Prices for feed barley in southern Alberta will likely hover in the range of $360-$380/tonne over the winter. I don’t expect significant upside because the barley market in Western Canada will be based on domestic demand. The lack of exports will limit the upside. The market will likely trade in line with U.S. corn as this is the largest substitute for regular feed barley usage. U.S. corn will continue to trade at a $15 discount to barley in southern Alberta over the winter. If adverse weather causes logistical problems, there could be periodic spikes.

Feedlot operators should extend coverage for the remainder of the crop year. I always encourage feedlot operators to have two or three weeks of barley in storage off-site in case of adverse weather or other logistical problems. Backgrounding operators and cow-calf producers should be aware the barley market is likely at seasonal lows. We’ll likely see slightly stronger barley prices over the winter. This may limit the upside in the feeder market.