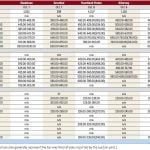

Compared to last week, western Canadian average yearling prices were steady to $3 lower while heavier replacements above 1,000 lbs. actively traded $3 to as much as $6 lower.

Weakness in deferred live cattle futures, along with rising feed grain prices, caused buyers to lower their bids accordingly.

Steers averaging 1,000 lbs. were readily trading from $163 to $165 across the Prairies while 950-lb. animals were quoted from $168 to $172.

Many backgrounding operators were passing on bids with hopes of turnaround in upcoming weeks. Margins for the summer period on calves bought last fall could turn quite disastrous, so replacement cattle need to offset the equity erosion.

Read Also

U.S. livestock: Feeder cattle hit contract highs on tight supply

Chicago | Reuters – All Chicago Mercantile Exchange feeder cattle futures and most live cattle futures hit contract highs on…

Larger-frame medium-flesh Angus-cross mixed steers averaging 880 lbs. traded for $172 in central Alberta; tan larger-frame medium- to thinner-flesh heifers averaging 850 lbs. were quoted at $165 in the same region.

Prices for calves and grassers held value with week-ago levels. Red- and white-face medium-frame steers averaging just over 600 lbs. were quoted at $234 in central Saskatchewan while 625-lb. heifers with similar features traded at $198. Lighter mixed steers averaging 450 lbs. traded for $265 just south of Calgary. Pasture conditions heading into spring are excellent. There’s strong demand for grassers and yearling supplies next August and September will be rather tight.

Feedlot operators are struggling to secure barley supplies. While the price has increased, grain merchants are having a difficult time delivering on time because of adverse weather over the past couple of weeks.

Alberta packers were buying fed cattle at $164 on a live basis, relatively unchanged from week-ago levels. The nearby fed cattle market has divorced from the futures market. U.S. slaughter during the first quarter is coming in lower than anticipated; however, the U.S. Department of Agriculture is projecting a year-over-year surge in second-quarter beef production which has weighed on the live and feeder cattle futures markets.

— Jerry Klassen manages the Canadian office of Swiss-based grain trader GAP SA Grains and Produits Ltd. and is president and founder of Resilient Capital, specializing in proprietary commodity futures trading and market analysis. Jerry consults with feedlots on risk management and writes a weekly cattle market commentary. He can be reached at 204-504-8339.