Chicago | Reuters — CME cattle futures fell on Wednesday as traders assessed higher feeding costs due to a sharp gains in corn.

Hog futures were also weak, falling for the sixth time in seven sessions, with prospects for more COVID-19 lockdowns in China further chilling the already weak export demand from the world’s top consumer of pork.

Feeder cattle contracts notched the biggest decline, with the most-active August contract shedding 2.4 per cent and hitting its lowest since Nov. 2.

“The unending rally in corn is certainly the focus,” said Rich Nelson, analyst at Allendale Inc.

Read Also

U.S. livestock: Feeder cattle hit contract highs on tight supply

Chicago | Reuters – All Chicago Mercantile Exchange feeder cattle futures and most live cattle futures hit contract highs on…

Chicago Board of Trade corn futures jumped to their highest in nearly 10 years on Thursday.

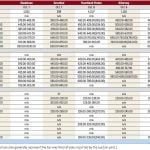

Benchmark June lean hogs settled down 0.825 cent at 110.35 cents/lb. (all figures US$).

Technical support for June hogs was noted at the low end of its 20-day Bollinger range for the second day in a row.

CME June live cattle futures dropped 1.225 cents to settle at 135.025 cents/lb., falling below their 20-, 30-, 40- and 200-day moving averages.

CME feeder cattle also were weaker, with May dropping 3.375 cents to 157.35 cents/lb. and most-active August feeders down 4.2 cents at 168.95 cents/lb.

— Mark Weinraub is a Reuters commodities correspondent in Chicago.