Chicago | Reuters — Chicago Mercantile Exchange lean hogs sank to a two-year bottom on Monday as funds kept selling February contracts and rolling their long positions into back months, traders said.

Funds involved in CME’s livestock markets that follow the Standard + Poor’s Goldman Sachs Commodity Index (S+P GSCI) shifted their February positions in a process known as the S+P GSCI roll.

Monday was the third of five days for the S+P GSCI roll procedure.

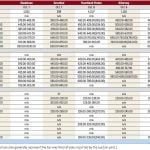

February closed 2.375 cents per pound lower at 76.65 cents, and April ended down 2.35 cents to 77.7 cents.

Read Also

U.S. Grains: Wheat ends up after hitting five-year low

Chicago Board of Trade wheat futures ended higher on Tuesday after falling to a five-year low on abundant global supplies. Corn also higher, while soybeans end down.

CME nearby lean hogs and live cattle contracts also were under pressure from fund liquidation associated with their annual rebalancing of commodity assets, which will conclude on Wednesday.

Monday morning’s wholesale pork price relapse, and investors waiting for a seasonal cash price recovery, exerted more fundamental pressure on futures.

The morning’s wholesale pork price had fallen $1.26 per hundredweight (cwt) from Friday to 82.7, according to the U.S. Department of Agriculture.

Market-ready or cash hogs on Monday morning traded steady with Friday’s prices, regional dealers said.

Wintry weather in parts of the Midwest made it difficult to transport hogs, which helped underpinned some cash prices, a trader said.

But, Monday’s 455,000-head slaughter reflects sufficient supplies, including a packing plant that processed on Sunday after it was idled by mechanical repairs last Friday.

Mixed live cattle settlement

CME nearby live cattle futures closed weak, but back months ended higher on fund rolling and rebalancing, traders said.

Live cattle February closed 0.15 cent/lb. weaker at 160.45 cents, and April down 0.075 cent to 159.35 cents. June ended 0.925 cents higher at 151.575 cents and August up 0.775 cent to 149.025 cents.

Upward-trending wholesale beef values, and futures’ discount to last week’s cash prices, periodically landed some contracts in positive trading territory.

Last week, slaughter (cash) cattle in the U.S. Plains sold $168-$172/cwt, feedlot sources said.

Monday morning’s choice wholesale beef climbed $1.56/cwt from Friday to $258.35. Select cuts rose $2.06, to $250.29, based on USDA data.

Nasty weather delayed the delivery of cattle to packers, while grocers booked beef for early February advertisements.

CME feeder cattle closed higher on deferred-month live cattle advances and technical buying.

January closed up 0.975 cent/lb. to 223.4 cents, and March finished 0.75 cents higher at 213.3 cents.

— Theopolis Waters reports on livestock futures markets for Reuters from Chicago.