Chicago | Reuters –– Chicago Mercantile Exchange live cattle futures closed mixed on Thursday, supported by initially higher cash prices while pressured by profit-taking, traders said.

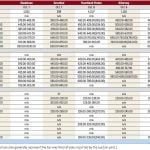

October live cattle ended up 1.625 cents per pound at 157.05 cents, and December at 158.5, up 0.5 cent (all figures US$). February finished 1.4 cents lower at 156.7, and April down 1.475 at 155.75 cents.

October periodically climbed the maximum three cents/lb. daily price limit after supply-strapped packers spent more for market-ready or cash cattle.

On Thursday, a few cash cattle in Nebraska moved at $158 to $160 per hundredweight (cwt), up $1 to $5 from last week, feedlot sources said.

Read Also

U.S. livestock: Feeder cattle hit contract highs on tight supply

Chicago | Reuters – All Chicago Mercantile Exchange feeder cattle futures and most live cattle futures hit contract highs on…

October and December futures’ buyers were encouraged by firm wholesale beef prices after plant shutdowns during the Labour Day holiday reduced the amount of product available to grocers.

Thursday morning’s choice wholesale beef price rose 55 cents/cwt from Wednesday to $248.13. Select gained 20 cents to $234.14.

Cash cattle price optimism prompted traders to simultaneously buy front months and sell deferred contracts in a trading strategy known as bull spreads.

CME live cattle eased for highs, with deferred futures well into negative territory, after investors had already priced in higher cash prices, a trader said.

Investors await remaining cash cattle sales before making their next move before the weekend, he said.

CME feeder cattle finished flat to higher, supported in part by lower corn prices.

September closed 1.1 cents/lb. higher at 223.8 cents. October ended up 0.225 cent at 222 cents, and November unchanged at 221 cents.

Hogs mostly lower again

CME hogs finished mostly lower for a second straight day after traders sold deferred months and at the same time bought the October contract in anticipation of continued firm cash prices, traders said.

October closed 1.55 cents/lb. higher at 102.65 cents. December ended down 0.65 cent, to 92.45 cents, and February 1.925 cents lower at 89.05 cents.

The morning’s average hog price in the eastern Midwest region gained six cents/cwt from Wednesday to $91.46, according to USDA.

Packers bought hogs for Saturday’s estimated 125,000-head slaughter and next week’s production.

Wholesale pork values could fluctuate as cuts more suited for cooking indoors begin replacing items associated with summer grilling, traders and analysts said.

The morning’s wholesale pork price dropped 33 cents/cwt from Wednesday to $101.26, largely led by the $7.67 decline in rib costs, USDA said.

February futures slide below the 100-day moving average of 90.89 cents triggered fund liquidation.

Fallen corn prices stirred more back-month hog futures selling in the belief that producers may expand their herds as grain costs come down.

— Theopolis Waters reports on livestock futures markets for Reuters from Chicago.