Chicago | Reuters — Chicago Mercantile Exchange lean hog futures climbed to fresh highs on Tuesday in a seventh straight session of gains, lifted by strong domestic demand and tight supplies of hogs.

Broader commodities market gains added support to hogs as concerns about a Russian invasion of Ukraine hammered equities markets and fueled worries about disrupted global flows of raw materials.

Technical buying accelerated gains in lean hogs, taking all contracts to new lifetime highs and spot April futures to the highest level for a front-month contract since mid-July.

Read Also

U.S. livestock: Cattle fall sharply as Trump says he’s working to lower beef costs

Chicago cattle futures fell sharply on Friday after U.S. President Donald Trump said his administration was working to lower the…

“Supplies are down more than we thought and disease in the herd continues to be rampant. Consequently, the market is moving higher to adjust,” said Don Roose, president of U.S. Commodities.

Pork packers have processed fewer hogs at times this year due to tight supplies or staffing shortages at plants.

Tuesday’s hog slaughter totaled an estimated 479,000 head, below the 499,000 head slaughter on the same day a year ago, according to U.S. Department of Agriculture (USDA) data.

Wholesale pork prices eased but the shorter slaughter figures were seen boosting pork prices in the future. Meanwhile, elevated beef prices may bolster demand for pork as some inflation-weary consumers switch to cheaper options like pork.

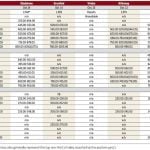

April lean hog futures jumped 2.675 cents to settle at 112.075 cents/lb., while June futures were up 2.6 cents at 121.225 cents/lb. (all figures US$).

CME live cattle futures were firmer on Tuesday on high beef prices and as harsh weather in U.S. Plains cattle areas triggered worries about slower rates of gain at feedlots.

April live cattle rose 0.15 cent to 146.025 cents/lb. March feeder cattle fell 1.2 cents to 164.225 cents/lb., pressured by corn feed prices at eight-month highs.

— Karl Plume reports on agriculture and ag commodities for Reuters from Chicago.