Chicago | Reuters — Chicago Mercantile Exchange live cattle futures closed mixed after choppy action on Wednesday as investors searched for clear fundamental direction, traders said.

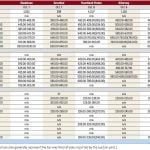

December live cattle closed up 0.075 cent per pound at 162.475 cents, and February was down 0.2 cent, to 162.85 cents (all figures US$).

Prices for market-ready (cash) cattle could drop for a second straight week due to ample near-term supplies as packers struggle to realign their unprofitable margins.

Conversely, sentiment that recent futures declines were overdone, and the morning’s beef cutout uptick, stirred short-covering and bargain hunting.

Read Also

U.S. livestock: Feeder cattle hit contract highs on tight supply

Chicago | Reuters – All Chicago Mercantile Exchange feeder cattle futures and most live cattle futures hit contract highs on…

Cash cattle bids in the U.S. Plains stood at $162 to $164 per hundredweight (cwt) versus up to $170 asking prices, feedlot sources said.

Wednesday morning’s choice wholesale beef price, or cutout, gained 17 cents/cwt from Tuesday to $250.68. Select jumped $1.51, to $237.61, the U.S. Department of Agriculture said.

The S+P 500’s more than one per cent tumble on Wednesday limited CME live cattle market advances because it could rattle consumer confidence in the economy.

“Plummeting crude oil prices and equities’ response to the Chinese stock market selloff is not an environment for confidence,” said Doane Advisory Services economist Dan Vaught.

Fund liquidation and the exchange’s weaker feeder cattle index pressured CME feeder cattle contracts.

January ended 1.175 cents/lb. lower at 231.6 cents, and March dipped 0.1 cent, to 227.25 cents.

Sideways hogs settlement

CME lean hogs closed mixed, with December supported by a slight discount to the exchange’s hog index for Dec. 8 at 88.35 cents, traders said.

Sagging cash hog and wholesale pork prices weighed on the February contract, they said.

Wednesday morning’s average cash hog price in Iowa/Minnesota fell $1.96/cwt from Tuesday to $82.90, USDA said.

Separate government data showed the morning’s wholesale pork price slumped $1.62/cwt from Tuesday to $91.83, pressured by $6.45 in lower costs for picnic shoulder cuts.

Several packers have sufficient supplies for the rest of this week’s production, partly due to mild weather in the Midwest and newly harvested corn that are conducive to hog weight gain.

Sputtering pork demand reflects retailers trying to balance pricey beef against relatively low-cost pork that has struggled after the U.S. Thanksgiving holiday, an analyst said.

December, which will expire on Dec. 12, closed up 0.325 cent/lb. to 87.275 cents, and February down 0.05 cent to 84.55 cents.

— Theopolis Waters reports on livestock futures markets for Reuters from Chicago.