Chicago | Reuters –– Chicago Mercantile Exchange lean hogs fell on Thursday for the first time in seven days, pressured by profit-taking on the eve of February’s final trading day, traders said.

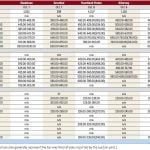

April futures closed 2.175 cents per pound lower at 67.15 cents, with May down 2.6 cents at 79.3 cents (all figures US$).

Some investors were concerned that packers would slash bids for market-ready or cash hogs after higher prices for them and lower wholesale pork values wore down their margins.

Icy roads and cold temperatures across most of the country disrupted livestock production, which fuelled the recent cash price rally.

Read Also

U.S. livestock: Feeder cattle hit contract highs on tight supply

Chicago | Reuters – All Chicago Mercantile Exchange feeder cattle futures and most live cattle futures hit contract highs on…

But harsh wintry weather in the northeastern U.S., and the backlog of pork that resulted from the recently resolved U.S. West Coast dock dispute, constricted meat sales.

Thursday morning’s average cash hog price in Iowa/Minnesota was up 56 cents per hundredweight (cwt) from Wednesday to $66.60, the U.S. Department of Agriculture said.

USDA data showed the morning’s wholesale pork price at $67.89/cwt, $1.58 lower than on Wednesday.

Cattle up third straight session

Short-covering and anticipation of steady cash prices for this week supported CME live cattle contracts for a third day in a row, traders said.

For the most part, cash bids stand at $157/cwt while sellers have dug in at $162, feedlot sources said. Reuters could not confirm rumours that packers in Nebraska hiked cash bids to $159 from $157.

Earlier this week, a few cattle in the U.S. Plains moved at $156 to $157/cwt, down from $158 to $160 last week.

The morning’s choice wholesale beef price gained $1.03/cwt, to $247.52, in light volume from Wednesday. Select cuts were up 0.25 cents to $245.18, based on USDA data.

Small beef volume sales suggest packers are having difficulty moving beef at current prices, said Archer Financial Services broker Dennis Smith.

With the February contract set to expire on Friday, investors zeroed in on April’s huge discount to last week’s cash prices.

April and June upward momentum accelerated after piercing their respective 10-day moving average of 149.7 cents and 142.6 cents.

February ended 2.775 cents/lb. higher at 161.125 cents, and April up 2.95 cents, to 149.8.

CME feeder cattle jumped on technical buying and live cattle futures gains.

March closed 3.325 cents/lb. higher at 200.3 cents.

— Theopolis Waters reports on livestock futures markets for Reuters from Chicago.