Chicago | Reuters — Chicago Mercantile Exchange live cattle futures ended higher on Thursday supported by short-covering and expectations of at least steady cash trade, traders said.

“The packers have tried to buy cattle on their own terms, but the supplies are so tight,” said Lane Broadbent, analyst at KIS Futures. “It appears they may have to pay up for the cattle,” he said.

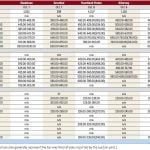

There were unconfirmed sales in Nebraska on Friday at $140.50-$141 per hundredweight (all figures US$). Earlier this week there were very light sales at $141-$142.50/cwt.

Read Also

Klassen: Cash feeder market divorces from futures market

For the week ending October 11, Western Canadian yearling markets traded $8/cwt higher to $5/cwt lower compared to seven days…

As of Friday afternoon there was talk of cattle priced at $142-$143/cwt, Broadbent said.

According to USDA data, the afternoon wholesale choice beef price was at $212.25/cwt, down $1.26 from Thursday and $11.24 lower than a week ago. Select cuts were at $209.96/cwt, down $2.35 and $14.89 less than a week ago, the data showed.

Beef packer margins on Friday fell deeper into the red to a negative $98.95 per head, compared with $77.75 per head and with a positive $12.30 a week ago, according to HedgersEdge.com.

With wholesale beef prices coming off recent highs and profit margins eroding, packers have been hesitant to pay higher prices for cattle. Some have pulled previously contracted cattle forward in an effort to buy fewer animals in the cash market and others will wait as late as possible to make purchases for the week, traders said.

USDA estimated 2014 year to date cattle slaughter at 3.2 million head, down nine per cent when compared with 2013 year-to-date slaughter of 3.5 million head.

“We know that supplies are at historical tight levels, but the question is can our demand improve? Will the economy support these high prices?” said Broadbent.

A Cargill beef processing plant at Schuyler, Neb., remained closed Friday while it was being repaired after a fire and ammonia leak forced it to shut early on Thursday, a company spokesman said. [Related story]

February live cattle ended at 141.2 cents/lb., up 1.18 per cent, or 1.65 cents. April ended at 140.4 cents, up 0.95 per cent, or 1.325 cents.

CME feeder cattle futures closed firm, supported by soft Chicago Board of Trade corn prices.

March ended at 167 cents/lb., up 0.075 cent, and April finished at 167.8 cents/lb., up 0.15 cent.

Firm cash lends support to hogs

CME lean hog futures ended firm in thin trade on Friday, supported by firm cash hog market, traders said.

Early on Friday Midwest hog brokers said cash prices were steady to 50 cents higher. The average price of hogs in the eastern Corn Belt on Friday morning rose 45 cents from Thursday to $80.27, according to USDA data.

Hog movement resumed but remained slow days after a winter storm dumped several inches of snow around the U.S. Midwest and Plains regions.

“You can get cattle to market, but it has been more of a pork issue as far as the weather is concerned,” a livestock trader said. The weather conditions have been difficult for pork packing plants and pork production, the trader said.

Packers need slaughter supplies for next week and want to clear through the backlogs of animals that were delayed earlier in the week due to the wintry weather and hazardous road conditions, hog dealers said.

February hogs closed at 86.575 cents/lb., up 0.075 cent. April ended at 94.725 cents/lb., up 0.525 cent.

— Meredith Davis reports on livestock commodity markets for Reuters from Chicago.