Fed cattle

Smaller slaughter numbers and lighter carcass weights through the holidays led to a stronger cash price as we started the new year. The first week of trade in 2023 ended with an average of $186.04/cwt, which was $1.54/cwt higher than the end of 2022 and over a $3/cwt improvement from the December low. Compared to the start of 2022, the first week of 2023 was $23.33/cwt stronger.

While packer buyers reached a little further at the end of 2022 and the start of 2023, pickup dates were still scheduled several weeks out. The higher trend continued as by mid-month the fed steer average was $186.35/cwt. However, the fed cattle cash-to-cash basis is still disappointing at -$22.35/cwt.

Read Also

Pen riders still better than tech at detecting respiratory disease in feedlot cattle, says researcher

Recent research found that pen riders are better than tech at flagging signs of BRD in feedlot cattle

[MARKET SUMMARY] Break-evens and market summaries for January 2023

The end of December saw a significant drop in steer carcass weights which indicates front-end supply is finally becoming more current. The average weights from the week of December 17 to 24 dropped 17 lbs. to 939 lbs, which is also down 34 lbs. from the peak weights in October. While carcass weights at the end of 2022 were smaller, they were still eight lbs. larger than the same week in 2021.

The December cattle-on-feed report showed increasing cattle-on-feed numbers in Alberta and Saskatchewan finishing lots. The total number of cattle-on-feed on December 1 was 1,157,803 head, which is three per cent smaller than in 2021, but still one of the largest December on-feed numbers on record. Placements were 21 per cent larger in November. This significant increase was due to both the earlier placements in the fall of 2021 as well as a shift back to net importers of feeder cattle in the third quarter. In the first on-feed report released for 2023, the January 1 on-feed total was three per cent lower than a year ago at 1,087,813 head.

Deb’s outlook for fed cattle: There is uncertainty in the market, and factors that affect the fed market such as inflation, interest rates and input costs need to be monitored closely. Fundamentals suggest fed cattle prices maintain solid ground as we move through January, which should lead to stronger prices later in the first quarter due to both tightened fed cattle supply in North America as well as seasonal improvement in beef demand. Further out in 2023, beef supplies are projected to be smaller, which will leverage prices.

Feeder cattle

Looking back, 2022 saw the second-highest feeder prices in history. However, increased feed costs, interest rates, inflation and energy costs took the profit out of producers’ hands. The fall run feeder lows were established in mid-November and saw modest improvement to the end of the year. The start of 2023 has seen a continuation of the steady improvement in most classes of cattle. Small volumes saw prices range based on quality and type. However, the average mid-January price for 550-lb.-feeder steers was $300.80/cwt, which is $75/cwt higher than the same week in 2022.

Heavier feeders are in demand. However, seasonally volumes of these weight-class sales are light this time of year. The week of January 13 saw the 850-lb.-steer average at $242.50, which is $51/cwt higher than the same week last year.

Feed costs in Canada still hover at record-high levels, putting Canadian feedlots at a feeding cost disadvantage to our U.S. counterparts. However, over the past few months Canada has become a net importer of feeder cattle. Feeder cattle exports through the fourth quarter were lower than a year ago, while exports for the entire year were up 38 per cent at 198,565 head exported in 2022.

Deb’s outlook for feeder cattle: Feeder futures are strong, volumes light and demand solid which all should support stronger prices on heavyweight feeder cattle. Input costs remain high, which will be the largest limiting factor for feeder prices. Over the next couple of months, lightweight calf volumes will be limited at auction. Prices should start to trend higher; however, later in the first quarter, price improvement is expected as grass starts to green and buyers look to stock pastures.

Non-fed cattle

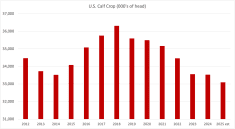

Continued drought across grazing regions of the U.S. caused significant herd reductions to continue throughout 2022. In Canada, the year ended with cow slaughter numbers up four per cent to a total kill of 470,051 head. In addition, larger volumes of cows were exported through the last quarter.

Cull cattle prices started 2023 on a strong note as both bull and cow prices surged higher in the first week of trade in the new year. D1,2 prices jumped $5.87/cwt the first week in January to $93.75/cwt, which is an increase from the fall low of $11.67/cwt and is nearly $20/cwt higher than the start of 2022. Bull prices have made a contra-seasonal move, increasing at the start of the year to an average of $124.88/cwt which is $25/cwt higher than at the start of 2021. Bull slaughter to the year’s end was down 11 per cent to 15,645 head while exports were larger, up 39 per cent to 13,809 head when compared to 2021.

Deb’s outlook for fed cattle: Cull cow volumes at auction through the remainder of January will no doubt be smaller than fall-run numbers. However, some cows that were held over as lower prices and extremely cold weather made hauling cows to town less than attractive will come to market in the new year. Expect a historically normal trend for the cull cow market with strong prices through the first quarter as spring approaches.