During the third week of August, a larger group of higher-quality 1,000-pound steers in central Alberta traded for $431/cwt., which equates to $4,310 per animal. The deferred live cattle futures were reflecting an Alberta dressed price of $500/cwt. A finished animal at 1,500 pounds live or 900 pounds dressed equates to a value of $4,500/cwt. Cattle producers have been phoning and emailing me and asking how feedlots can add 500 pounds to an animal for 38 cents per pound.

Current cost per pound gains have been hovering around $1 per pound, which includes feed costs only. This doesn’t take into account interest charges or other costs such as yardage and processing. Feedlot operators are factoring in lower feed grain prices, but this is fairly extreme. Therefore, I thought this was an optimal time to provide an overview of the feed grain fundamentals for the 2025-26 crop year.

At the time of writing this article in late August, Lethbridge-area feedlots were buying feed barley in the range of $270-$278 delivered, while central Alberta operations were making purchases from $245/tonne to $270/cwt. Imported U.S. corn was trading for $280-$290/tonne in southern Alberta. Wheat for feed usage was trading in the range of $270-$300/tonne in central and southern Alberta. The average elevator bid for No.1 and No.2 CWRS 13 per cent protein was $266/tonne. Farmers in southern Alberta with milling quality wheat have been encouraged to sell into domestic feed channels which has limited the upside in the feed wheat market.

Read Also

Picking the most efficient cows to rebuild your cow herd

A new cow ranking system to help beef farmers and ranchers pick the most efficient cows as they rebuild their herds.

The Canadian barley crop will yield better than earlier anticipated. I’m now forecasting a barley crop of nine million tonnes, up from last year’s crop of 8.1 million tonnes. It’s important to realize that farmers like to sell feed barley off the combine as a cash crop to pay bills. Farmer deliveries during September will likely reach 800,000 tonnes while October and November deliveries have potential to reach one million tonnes. Cattle-on-feed inventories are at seasonal lows during August and September. During September, domestic feed demand is only about 400,000 tonnes. Domestic processing demand for malt purposes is about 70,000 to 80,000 tonnes per month in the first half of the crop year. Supplies exceed demand, which will result in a lower price. The barley market will function to encourage offshore movement.

Canadian non-durum spring wheat production has the potential to reach 26.5 million tonnes, up from the 2024 crop of 26.1 million tonnes. The Canadian wheat crop over the past few years has been high quality with nearly perfect harvest conditions. In a normal year, non-durum wheat used for feed in the domestic market averages about four million tonnes. Usually, farmers in the major feeding areas of Alberta sell milling-quality wheat into feed channels. A different scenario is developing this fall. A large portion of Alberta and Saskatchewan received 50 to 100 mm of rain during the first half of August. Intermittent rains are in the seven- to 10-day forecast. There will be quality issues this year.

I’m estimating about five to six million tonnes of hard red spring wheat will be feed quality. Domestic demand for feed wheat is about three to 3.4 million tonnes in a normal year. Canadian feed wheat cannot compete with lower-priced Ukrainian and European feed wheat. Therefore, this volume must move into the domestic feed market. There will be selling pressure during fall because farmers don’t like to store feed wheat for long periods.

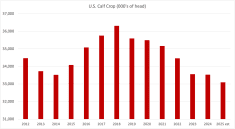

Earlier in summer, we were expecting the U.S. corn crop to reach 400 million tonnes. The latest USDA report had U.S. corn production at 425 million tonnes, up from the 2024 output of 378 million tonnes. Keep in mind that this record U.S. corn crop comes on the heels of record Brazilian output. The function of the corn market is to encourage demand through lower prices. U.S. farmers sell about 65 per cent of the corn crop from September 1 through December 1. The main U.S. corn harvest occurs in October. New-crop corn will only arrive in Alberta in November. At the time of writing this article, the December corn futures were trading around $4.05/bushel. I’m expecting the December corn futures to trade down to the range of $3-$3.25/bushel during harvest.

In past years, there was a demand pull for U.S. corn into Alberta feedlots. In the 2025-26 crop year, there will be a supply push. Imported corn will likely trade below domestic barley prices. I wouldn’t be surprised to see U.S. corn trade as far north as Edmonton during the winter.

In conclusion, Canadian barley production will be up from last year and farmers like to sell barley in the fall. Adverse rains during harvest will result in five to six million tonnes of actual feed wheat production in Western Canada. Feed wheat must trade into the domestic feed market. The record U.S. corn crop will pressure the North American feed grains complex. Imported U.S. corn prices will be discount to the Lethbridge and Red Deer barley markets from November forward. Feedlot operators are counting on barley and corn prices dropping $30-$40/tonne or about $1/bushel from current levels. c