I’ve received many inquiries from cow-calf producers and backgrounding operators regarding the price outlook for feeder cattle. Western Canadian yearling prices made fresh 52-week highs earlier in fall; however, calf prices have been rather sluggish. In many cases, Alberta calf markets have been trading $5 to $10 below year-ago levels. Cow-calf producers are asking when would be an opportune time to sell their calves; backgrounding operators are asking what weight category they should purchase and when yearling prices will make seasonal highs next spring.

When looking at any market, one has to start by asking what does the market need to accomplish over the next year. At extremely low prices, the market discourages production and encourages consumption; at extreme highs, the market encourages production and rations demand. High prices discourage consumption.

Read Also

Canadian Beef Check-Off Agency reports on investments and activities

The check-off agency’s work behind the scenes is what ensures cattle check-off dollars are invested wisely, accounted for transparently and deliver measurable value back to producers and importers.

The feeder market is somewhat unique for three reasons. First, there is no real equilibrium price range where we can say supply and demand are in balance. Second, at extreme highs, the feeder market has an inverted supply curve. In a normal market, higher prices pull more supply onto the market. With regard to feeder cattle, there is a period where higher prices restrict market supplies because of heifer retention. Third, in a normal market, low prices result in less supply coming on the market. With regard to feeder cattle, low prices boost higher beef production. The higher cow slaughter and larger beef production tend to drop feeder cattle prices to abnormal lows. This is a basic theory of the feeder cattle market.

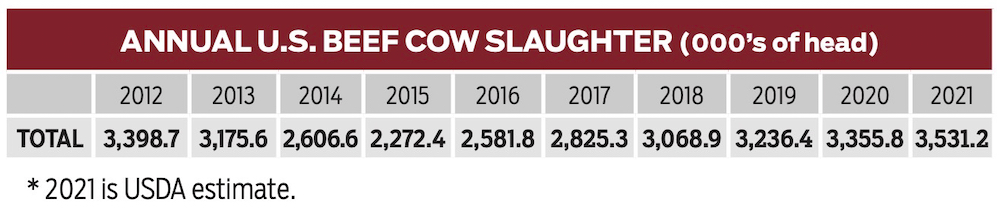

To start, one has to look at the year-to-date cow slaughter and the longer-term historical pattern. The U.S. cow slaughter from January 1 through August 31 was 2.35 million head. This was up 175,700 head from the same time frame of 2020 and up 273,800 from the same time frame of 2019. The U.S. cow herd is contracting; this is sure.

Above is a chart of the annual U.S. cow slaughter from 2012 through 2020 with the projection for 2021. The 2021 U.S. cow slaughter is expected to reach 3.5 million head. The U.S. cow slaughter has been trending higher since 2015. Notice the pattern from 2012 through 2015 when the cattle herd was also contracting. In the previous issue, I had a chart of the annual calf crop. The U.S. calf crop actually made a low in 2014 and then increased in 2015. Notice the cow slaughter actually declined for a couple of years before the low in 2015. The year 2015 was a low for the cow slaughter but the calf crop actually increased in 2015. During the latter half of 2014 and first half of 2015, the feeder market had an inverted supply curve where the market moved to extreme highs.

I’ve included a chart of monthly feeder cattle futures (see below). The market has traded in a range from $130 to $160 from 2016 through the first half of 2021. The calf crop made a high in 2018 but has been declining from 2019 through 2021. We’ll likely see another year-over-year decline in 2021 and 2022. The market has been discouraging production from 2019 through 2021. Now that we see the cow slaughter at higher levels, we can say the function of the market will be to encourage production. The market needs to move to fresh highs to encourage cow-calf producers to retain heifers and hold off on marketing cows.

In the futures chart, you can see the feeder market has traded in a range for about five years. From a technical perspective, when a market trades in a range for a long period and then breaks out of the range, there is usually a significant move. We saw this in barley and canola this past year. These commodities made fresh all-time highs after breaking above previous yearly ranges. The feeder cattle market is in the process of breaking out of the five-year range.

The feeder cattle market is expected to remain relatively flat through February of 2022. In late February or March, I’m expecting a major rally in the U.S. and Canadian feeder cattle markets. I believe the feeder cattle futures need to move to the range of $180 to $200 so that the U.S. cow-calf producer starts to retain heifers and reduces the cow slaughter. Remember, the feeder cattle futures are the live cattle five months forward. At the time of writing this article, the December 2022 live cattle futures were at $137 which is the same value as the April 2022 contract. The sharp year-over-year decline in U.S. beef production during the fourth quarter of 2022 will result in strong feeder cattle prices in the spring. Cow-calf producers will want to hold their feeder cattle as long as possible. It will be costly with the higher feed grains and forage but you will be rewarded. Backgrounders, buy lightweight calves to sell in April and May of 2022 at 850 pounds. This is the clear strategy.