In late April, Alberta packers were buying fed cattle on a dressed basis at $486/cwt delivered, up about $30/cwt from a month earlier. Using a 60 per cent grading, live prices during the last week of April would equate to $292/cwt, up from the late March value of $274. In Kansas, live prices were quoted at US$213/cwt freight-on-board feedlot on April 24, up from US$210/cwt a month earlier. I’ve received many calls from feedlot operators over the past month asking how high the live cattle market can go. When will the market turn lower? At the time of writing this article on April 28, I was telling feedlot operators that the market would likely turn in mid-May and then grind lower into the summer period. There are two main factors to consider. They’re called supply and demand.

Let’s look at the supply situation first. The U.S. slaughter during January was similar to last year while the February slaughter was down 289,000 head from last year. The year-over-year decrease for March was 69,000 head and 157,000 head for April. The U.S. slaughter is coming in below year-ago levels.

- MORE with Jerry Klassen: Stronger fed cattle markets lifts feeder complex

U.S. cattle on-feed for slaughter as of April 1 were 11.638 million head, down only two per cent or 352,000 head from April 1, 2024. U.S. feedlot placements during the first three months of 2025 were 5.217 million head, down 216,000 head from the first quarter of 2024.

The important information is in the details. Given the lower slaughter pace, cattle on-feed 150 days or longer as of April 1 were 3.272 million head, up 4.3 per cent or 134,000 head from April 1, 2024. Despite the lower on-feed number, market-ready supplies are above year-ago levels. Keep in mind that U.S. dressed weights are also running 24 pounds above last year.

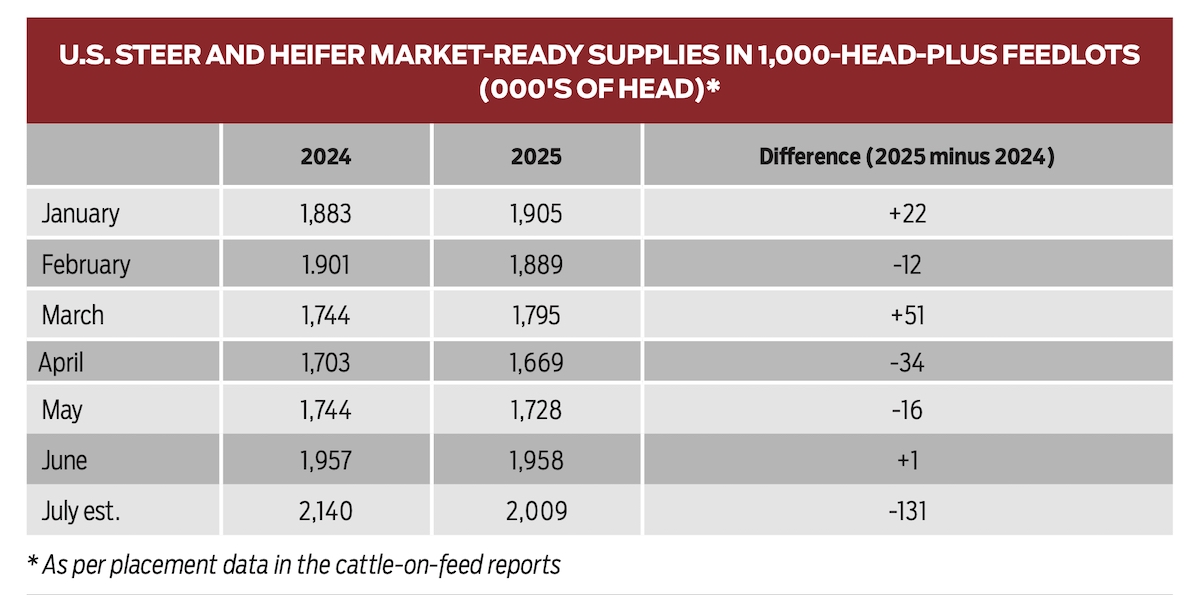

The U.S. cattle-on-feed reports have placements by weight category. We use the placements by weight category to project the number of cattle available for slaughter.

Read Also

U.S beef industry faces demand risks and disease dangers

High beef prices and New World screwworm threaten beef demand and cattle health in the U.S.

For the 2025 calendar year, monthly supplies decrease from January through April before increasing in May. Notice that supplies make a seasonal high in July. Supplies will increase as cattle on-feed 150 days or longer as of April 1 were up 134,000 head from last year.

The second factor to consider is demand. At home and away from home, food spending makes seasonal lows during January and February. During March, U.S. restaurant sales were up 2.8 per cent from March 2024 and up a whopping 15.8 per cent from February 2025. Food spending tends to make a seasonal high during March, April and May and then soften during June and July. Demand doesn’t drop sharply but the main point is that it’s not increasing.

The tariff uncertainty has caused U.S. wholesale beef prices to incorporate a risk premium. It appears that the tariff uncertainty is subsiding as packers get a better handle on imports and exports for the remainder of 2025. The risk premium in the wholesale beef market will subside in the summer when market-ready cattle numbers increase.

Another factor that I always refer to is the Commitments of Traders Report for the live cattle futures. The latest report had the commercial position short nearing 150,000 contracts. When the commercial position is at this level, it tells us that U.S. packers have nearly all their requirements covered. We can say demand is nearly full.

In conclusion, the live cattle futures are likely near or at the top. The tightest fed cattle supply situation occurs from April 15 to May 15. After this, market-ready cattle supplies increase as cattle on-feed 150 days or longer are above year-ago levels.

Beef demand is hitting seasonal highs. Demand will stagnate at best. It doesn’t usually increase significantly enough to drive the market higher. The risk premium for the wholesale beef market will erode moving forward.