The western Canadian yearling market rallied $8-$10/cwt throughout August. While yearling prices were percolating higher, barley prices in Western Canada were grinding lower. Farmers started harvesting barley in southern Alberta during the third week of August and progress will accelerate across the Prairies through September. Most feedlots had their feed grain requirements covered with U.S. corn until the end of August. In September, most finishing rations will switch over to barley. In the Lethbridge area, feed barley was trading at a $50-$60/tonne discount to U.S. corn for September and October delivery. The barley harvest in Western Canada will be completed by the end of September while the U.S. corn harvest will only move into high gear during October. Barley prices have divorced from the corn market due to the earlier harvest period.

[RELATED] Feed weekly outlook: Barley values steady, wheat rises

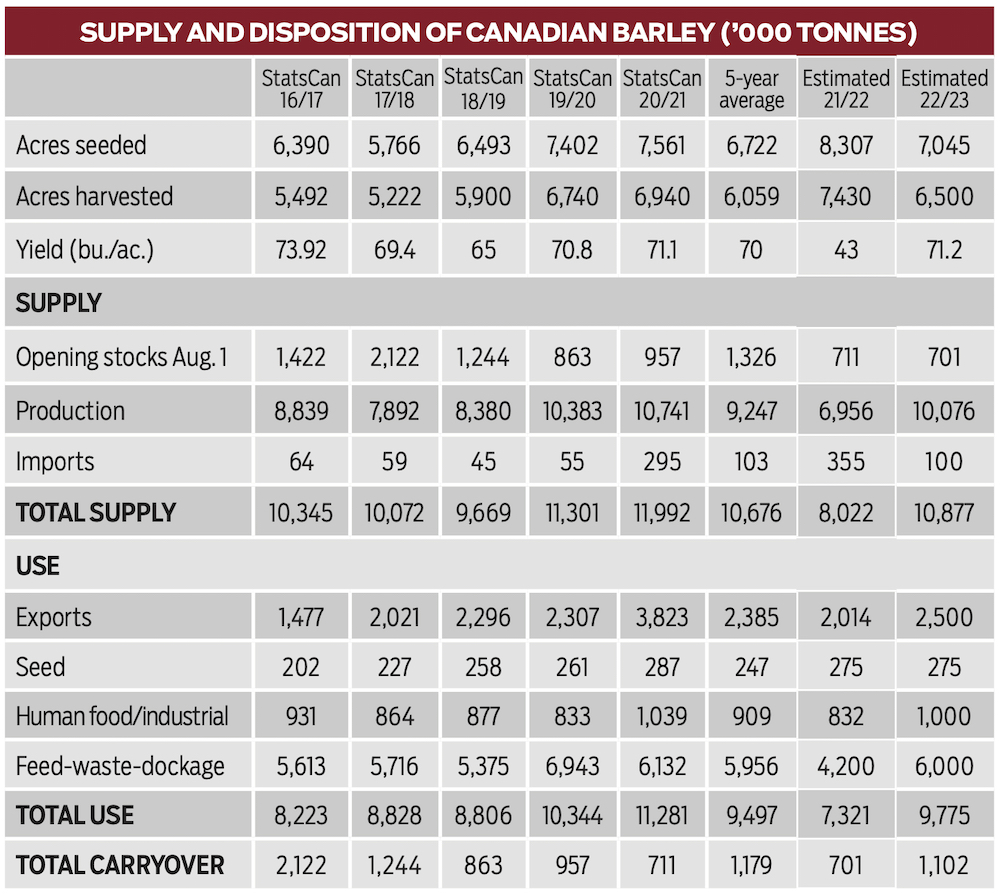

I’ve received many calls from cattle producers regarding the barley outlook. There have been a few major changes from earlier in the summer. Statistics Canada released their first crop-production estimate on August 29. Second, a ruling regarding Chinese tariffs on Australian barley is expected from the World Trade Organization (WTO) in December. In this issue, I’ll provide a review of the Canadian barley fundamentals and U.S. corn production.

Read Also

Factors influencing cattle feeder market during the fall of 2025

Market analyst Jerry Klassen weighs in on live cattle markets

According to Statistics Canada’s model-based survey, Canadian farmers are expected to harvest 9.3 million tonnes of barley this fall, up from the 2021 output of 6.9 million tonnes. Statistics Canada estimated the Canadian barley yield at 67.8 bushels per acre; however, the five-year average yield is 70 bushels per acre. Barley traders believe Statistics Canada is too low on their yield estimate. Statistics Canada will release their final yield and production estimate on December 2. This is when we’ll have the most accurate data for seeded and harvested area and yield. My contacts across Western Canada suggest that the barley yield will be closer to 71 bushels per acre. I’m also using a larger harvested area than Statistics Canada. We’re seeing more soft white spring wheat and corn used for silage in Western Canada. My 2022 production estimate is 10.1 million tonnes.

Export projections for the 2022-23 crop year are quite variable. There are two major changes from the 2021-22 crop year regarding Chinese demand for Canadian barley. First, we mentioned in August that China is now allowing imports of Russian barley. Second, the WTO will release their ruling regarding the 80.5 per cent Chinese tariff on Australian barley. Recent media reports suggest that China will abide by the ruling. There is no doubt in my mind that this decision will be in Australia’s favour. There is potential for Canadian barley exports to China to come to a standstill after January 2023.

I’m forecasting a Canadian barley carryout near 1.1 million tonnes for the 2022-23 crop year, which is similar to the five-year average ending stocks of 1.2 million tonnes. Keep in mind I’m still expecting Western Canada to have five million to six million tonnes of actual feed wheat due to the later-seeded crop. This will ensure there is no shortage of feed grains in Western Canada for the 2022-23 crop year.

December corn futures dipped down to $5.62/bu. on July 22. At the time of writing this article, the December corn futures were trading near $6.80/bu. The market has been incorporating a risk premium due to the uncertainty in production. The USDA estimated corn production at 365 million tonnes on the August World Agriculture Supply and Demand Estimate (WASDE). Traders are now expecting the U.S. corn crop to finish in the range of 350-355 million tonnes. The U.S. corn fundamentals will likely be tighter than earlier projections. This will provide underlying support to the Canadian barley market and limit the downside for the coarse grain complex.

At the time of writing this article, cash corn prices in Nebraska for October delivery were averaging US$6.75/bu. or US$264/tonne. In Lethbridge, barley for October delivery was quoted at C$360/tonne. Using an exchange rate of US$0.77 cents, the price of barley in Lethbridge would be US$277/tonne. Prices are very similar. In the 2021-22 crop year, U.S. producers had a major competitive advantage with input costs. For 2022-23, Alberta and U.S. producers will be on more equal footing.

If my fundamental projections are correct, Alberta producers will have a competitive advantage in the latter half of the crop year. This will cause Canadian feeder prices to trade at a premium to U.S. feeder cattle next spring.