Statistics Canada’s acreage survey of 9,500 farmers was conducted between December 12 and January 14, 2023. Survey results were released on April 26. Commodity and fertilizer prices have changed significantly since winter. Although the data may be out of date, traders are using it as a starting point to project upcoming production. On the winter survey, Canadian farmers were expected to plant 7.08 million acres of barley this spring, up only 40,000 acres from last year.

My straw poll of industry representatives, traders and farmers at the end of April suggested the Statistics Canada survey was a bit low. Traders expect barley acres to come in at 7.5 million on the June survey which will be released in late June. Feeder cattle prices for fall delivery are at historical highs and margins are razor thin. Barley prices will determine feedlot profitability for the latter half of 2023. It’s important that cattle producers understand the fundamental structure for the fall period. In this article, I’ll provide a brief overview of the supply and demand projections for the 2023-24 crop year.

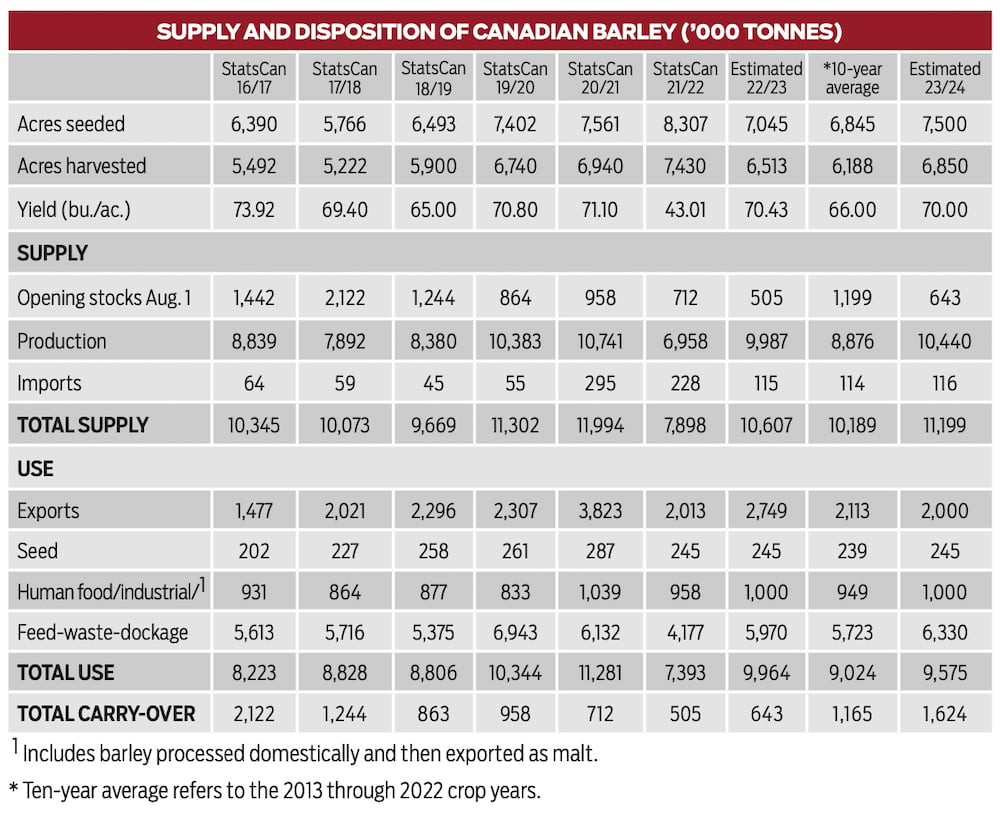

I’m expecting Canadian farmers to seed 7.5 million acres of barley this spring. This is up from last year’s area of 7 million acres and up from the 10-year average acreage of 6.8 million. Using a traditional abandonment rate and a trend yield of 70 bu./ac., production has the potential to reach 10.4 million tonnes. This is up from the 2022 production of 10 million tonnes and up from the 10-year average output of 8.9 million tonnes.

Read Also

Factors influencing cattle feeder market during the fall of 2025

Market analyst Jerry Klassen weighs in on live cattle markets

FEED WEEKLY OUTLOOK: Market in a waiting game

In May 2020, China implemented a tariff of 80.5 per cent on Australian barley. Demand surged for Canadian and French barley to fill the void in China. In April 2023, Australia and China reached a deal in their barley dispute. China will conduct a three- to four-month review of the tariffs in exchange for Australia halting its complaint at the World Trade Organization. Traders anticipate Australian barley will flow to China starting in October 2023. Chinese imports of Canadian barley are expected to reach 2.4 million tonnes in the 2022-23 crop year. Chinese imports of Canadian barley will likely be around 1 million tonnes in the upcoming crop year and this will be for malt processing.

Total Canadian barley exports for the 2023-24 campaign are expected to reach 2 million tonnes, down from the 2022-23 exports of 2.7 million tonnes. Canadian barley will have to be priced in line with German and French barley into Middle East destinations to reach this objective. At the time of writing this article, German and French barley was trading at a sharp discount to barley of Canadian origin for new-crop positions.

Domestic demand for the 2023-24 crop year will be similar to the 10-year average with a minor increase in feed usage. Ending stocks for 2023-24 are projected to finish near 1.6 million tonnes, up from the 2022-23 carryout of 642,000 tonnes and up from the 10-year average of 1.2 million tonnes.

The larger Canadian barley crop will come on the heels of a bearish world coarse grain complex. The main Brazilian corn harvest will occur in June and total production is expected to reach 125 million tonnes, up nine million tonnes from 12 months earlier. U.S. corn production is forecasted at 385 million tonnes, up 35 million tonnes from 2022. European corn production is expected to recover to 68 million tonnes, up from last year’s crop size of 54.2 million tonnes.

Earlier in February, new-crop barley was trading in the range of $375-$385/tonne delivered to Lethbridge. Given the year-over-year decrease in exports and the larger production, barley prices in Lethbridge have the potential to drop below $300/tonne delivered during the harvest period. Last year, Chinese demand stepped forward for new-crop barley in February and March, resulting in stronger barley prices in the non-major feeding regions of Western Canada. This fall, new-crop feed barley prices will be based on the domestic feed market. This should support the feeder cattle market.

Having said that, markets are efficient. Feedlot operators have been factoring in lower barley prices when purchasing feeder cattle for fall delivery. If drier conditions materialize and yields look to come in below 70 bu./ac., feeder cattle prices will come down. If a bumper crop materializes in Canada and the U.S., we could see additional upside in the fall feeder market.